BLA Premier Link

Maximum sum assured

up to 250 times*

Set your own insurance premiums, flexibly adjust your own sum assured, and invest in flexible proportions at different stages of your life.

Increase your chances of earning returns from investing in mutual funds and manage your investment portfolios according to your acceptable risk profile

Issued age Issued age |

Newborn – 70 years |

|---|---|

Life coverage until age Life coverage until age |

99 |

Life coverage insurance premium Life coverage insurance premium |

Minimum 12,000 baht per year |

Loyalty bonus** Loyalty bonus** |

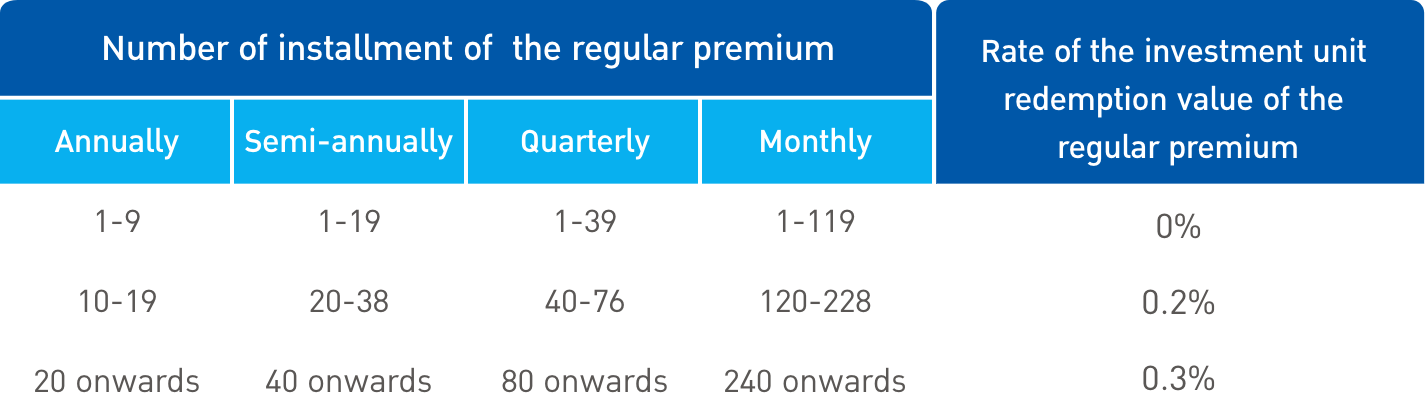

An opportunity to receive a special regular premium bonus (Loyalty Bonus) up to 0.3% of the investment unit redemption value of the regular premium. |

Tax deductible Tax deductible |

Premium charges, administration fees, and cost of insurance are eligible for tax deduction in accordance with the announcement from the Revenue Department. |

*of the annual life coverage insurance premium for all cases of death, according to the company’s term and conditions

*The insured will be qualified for a loyalty bonus on the regular premium after consistently paying their premiums fully for the required number of installment terms. This bonus right terminates upon the following conditions: 1) the policy's lapse and termination, 2) a decrease in the regular premium amount, or 3) a partial withdrawal from the policy's investment units.

Note : BLA Premier Link is the marketing name of BLA Premier Link Unit Linked life insurance product with regular installment premium payment.

| Issued age | Newborn – 70 |

|---|---|

| Coverage period | Until age of 99 |

| Premium payment period | Until age of 99 |

| Premium payment mode | Annually, semi-annually, quarterly and monthly |

| Regular premium | The regular premium is a combination of life coverage insurance premiums and Unit Deduction Rider (UDR) premiums (if any). However, the minimum and maximum amount of the regular premium are in accordance with the company’s term and conditions |

| Life coverage insurance premium | Choose your desired life coverage insurance premium rates, starting at 12,000 baht per year. The insured can decrease the life coverage insurance premium amount starting in the fourth policy year. |

| Top-up Premium (Top-up Premium) |

The insured can increase investment amount with two type of Top-up Premium payment.

|

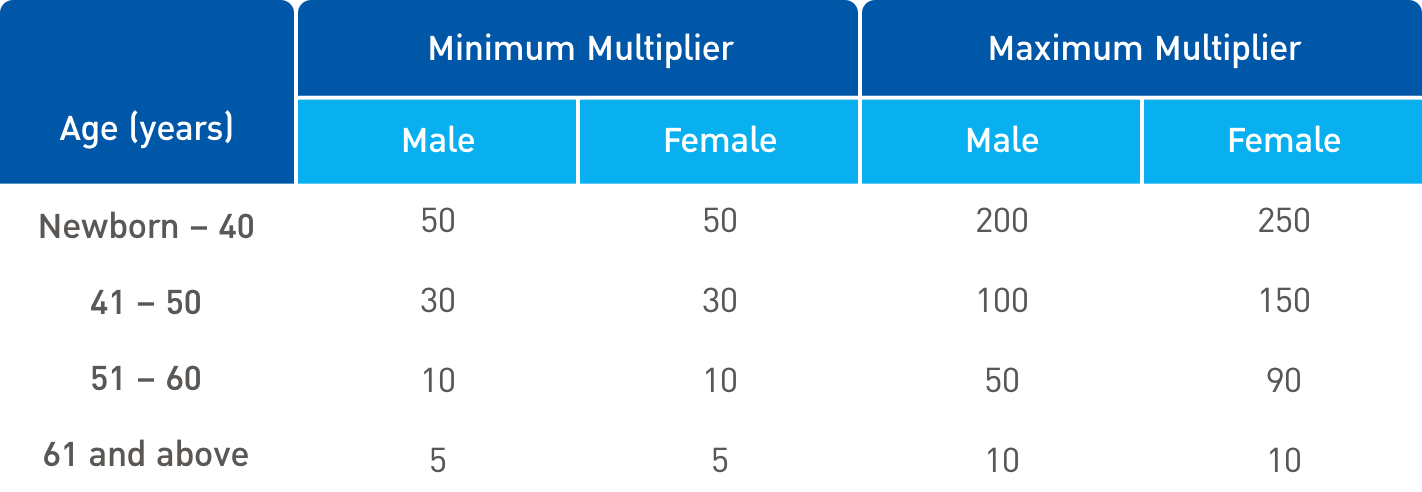

| Sum assured | The sum assured can be set and adjusted flexibly at monthly policy anniversary. Such sum assured adjustment must be using a multiplier with the annual life coverage insurance premium (for standard risks) as follows:

Maximum sum assured: Multiplied by the age at purchase Minimum sum assured: Multiplied by the current age |

| Death benefits | The company will pay the benefit amount whichever is the higher between 1. or 2.

|

| Survival benefits | The company will pay the investment unit redemption value to the insured. |

| (Loyalty Bonus) for regular premium* | The company will pay a special loyalty bonus to the insured with survival benefits and whose policy is still in effect. The insured must consistently pay regular premiums fully for the required number of installment terms. as follows:

|

| Investment funds offered as part of life insurance plan |

The company will select various types of funds, including Domestic Money Market, General Fixed Income, Mixed, Equity, and alternative asset funds. |

Note :

*The insured will be qualified for a loyalty bonus on the regular premium after consistently paying their premiums fully for the required number of installment terms. This bonus right terminates upon the following conditions: 1) the policy's lapse and termination , 2) a decrease in the regular premium amount, or 3) a partial withdrawal from the investment unit redemption value of the regular premium

Note : This example sum assured is designed to illustrate the plan only.

Additional Riders Additional Riders |

Riders such as health or critical illness riders can be additionally purchased according to the company’s term and conditions |

Premium Holiday Premium Holiday |

After successfully completing the 3-year installment period for the regular premium payments, you are eligible to defer these payments for a designated period, known as a premium holiday. During this time, policy will remain in-force as long as the investment unit redemption value is sufficient to covers the monthly policy fee, as specified in the policy. |

Fund Switching Fund Switching |

Unlimited fund switching with no fees. |

Non-Lapse Guaranteed Non-Lapse Guaranteed |

The coverage is effective throughout the first 10 years from the effective date of the policy although the investment units redemption value is not sufficient for paying the monthly fees. This benefit is subject to the following conditions:

|

Automatic Fund Rebalancing Automatic Fund Rebalancing |

The Company will automatically re-balance the investment portfolio once a year to maintain asset allocation in accordance with the Insured’s original investment objective. |

Investment funds offered as Investment funds offered aspart of life insurance plan |

Selected by experts from the company and managed by leading asset management companies. See more details at www.bangkoklife.com |

Completeness of the insurance contract

Knowingly providing false or misleading statement on the insurance application may result in the company increasing the Cost of Insurance and insurance premiums and rejecting the application, if discovered later. Under Section 865 of the Civil and Commercial Law, any contract obtained through such information is invalid, in which the company may void the contract and deny all policy payouts. In such cases, the company’s liability is limited to returning the investment unit redemption value, any premiums paid for separate rider coverages (if any), and paid policy fee except those for financial reports.

The company will not pay the following cases:

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part.

- In the event the insured is murdered by the beneficiary.

- In the event the declaration of age is incorrect and inaccurate that the actual age is outside the standard premium rate.