- Issued age : 0 - 65 years

- Initial sum assured : 50,000 baht

- Premium payment mode : Annually, semi-annually, quarterly, and monthly

- Health check-ups are in accordance with the company's underwriting criteria

- Additional riders can be purchased, according to the conditions set by the company

- Happy Whole Life (Par) consists of Happy Whole Life (Par) with premium payment terms of 5, 10, and 15 years and Happy Whole Life 9901 (Par) single premium, which are the marketing names for Prestige Life (Par) and Prestige Life (Par) single premium

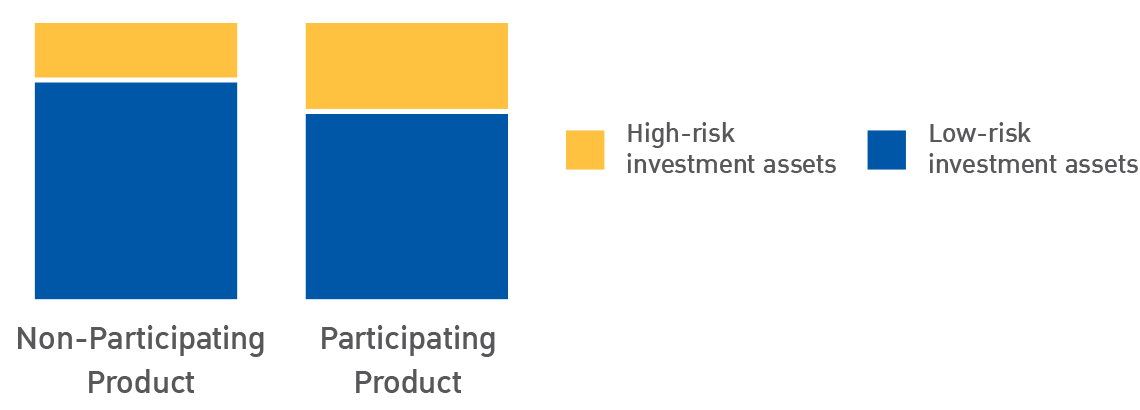

To meet the needs of planning in each aspect of life, the endowment insurance with Par is designed to improve your chances of generating higher returns with investment proportion in assets which are different from Non-Participating Product by increasing the investment proportion in high-risk assets along with managed with a dedicated investment portfolio. Expertise and efficiency for aiming in good and appropriate returns in each period.

Comparison of Investment Proportion between Non-Participating and Participating product

Investment Strengths

Separated investment portfolio*

Participating product portfolio provides investment flexibility for higher chance of receiving higher returns with minimum guarantee return

Bottom-Up analysis

For better investment decisions, this results in good and appropriate returns in each period of time

Manage and monitor investment portfolio

By experts and efficient management system

* To increase the opportunity to receive higher returns, the company has a policy to invest in high-risk assets for Participating Product in a higher proportion than Non-Participating Product. High-risk assets include common stocks and real estate funds both domestically and internationally, including businesses with long-term high growth prospects such as those in the technology and health sectors.

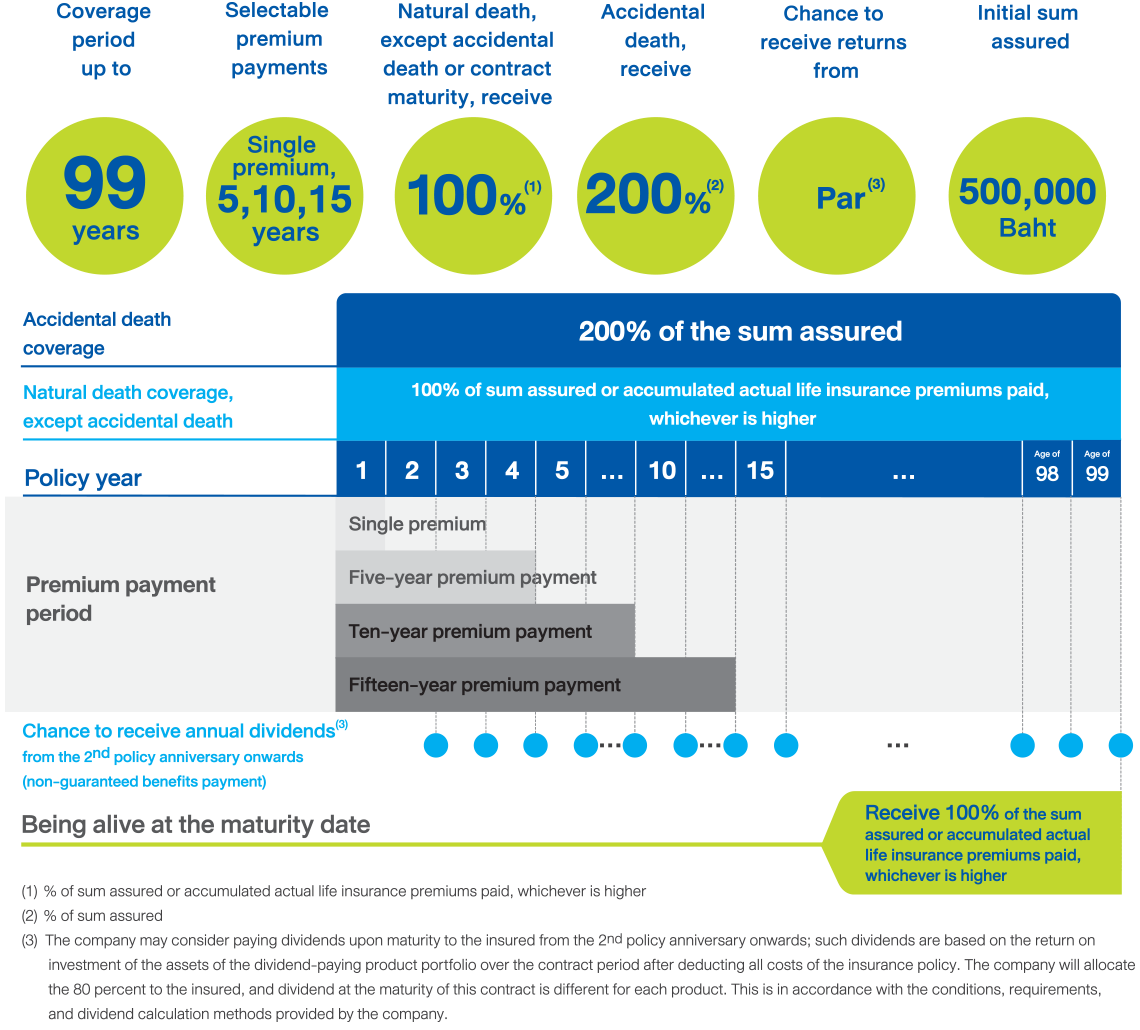

| Coverage | Benefits |

|---|---|

| 1. Natural death coverage, except accidental death |

|

| 2. Being alive at the maturity date |

|

| Extra coverage | |

| 3. Accidental death |

|

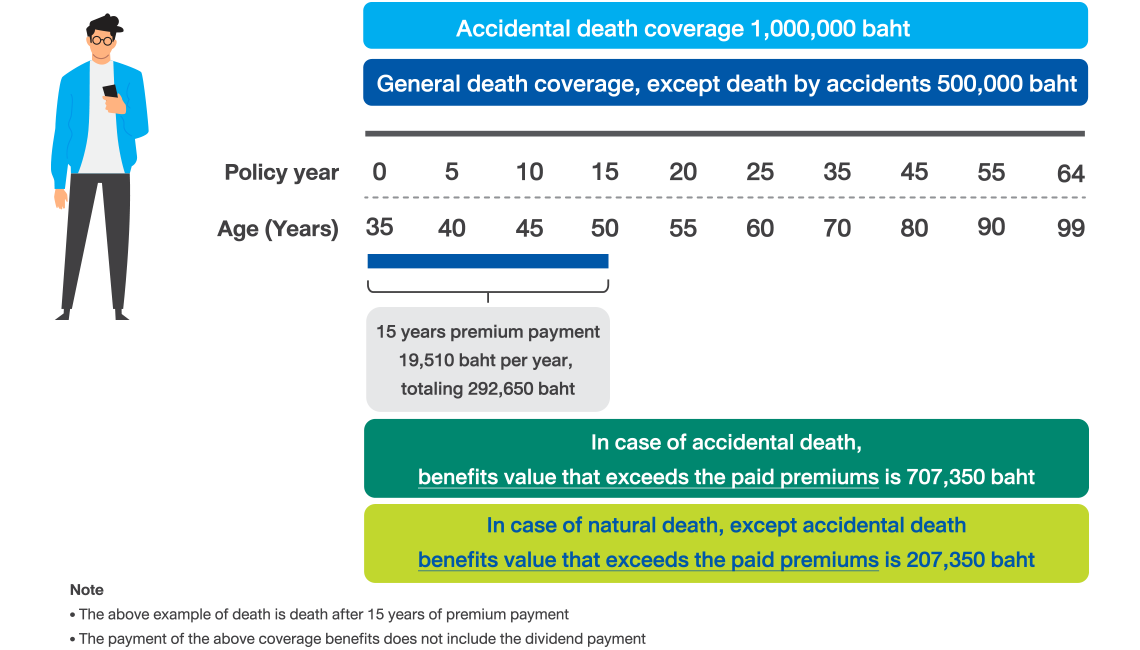

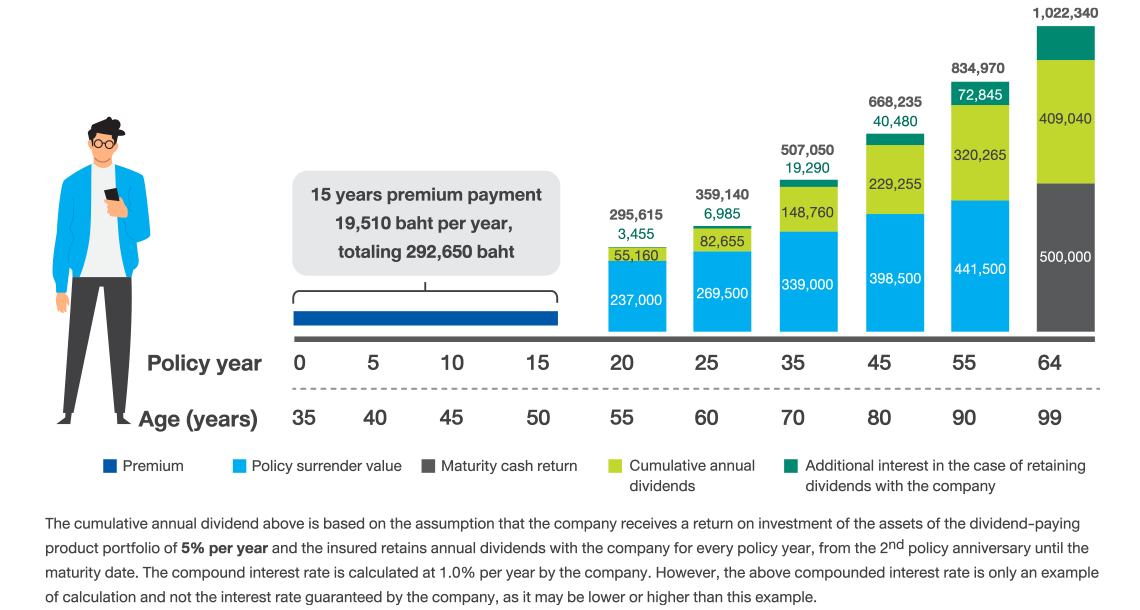

A 35-year-old male in good health applies for Happy Whole Life (Par) with an insured period up to the age of 99. His premium payment period is 15 years with 500,000 baht sum assured. He pays an annual premium of 19,510 baht per year and has a personal income tax rate of 10 percent throughout the contract period.

Unit : Baht

| Policy year | Annual Insurance premium (at the commencement of policy year) |

Example of dividends from average return on investment throughout the contract(3) |

Life coverage | Total eligible cash return before maturity |

Tax benefits | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Natural death coverage, except accidental death |

Accidental death coverage | ||||||||||

| Per year | Accumulated | 3% | 4% | 5% | % of the sum assured |

Amount | % of the sum assured |

Amount | |||

| 1 | 19,510 | 19,510 | 0 | 0 | 0 | 100% | 500,000 | 200% | 1,000,000 | 0 | 1,951 |

| 2 | 19,510 | 39,020 | 50 | 160 | 265 | 100% | 500,000 | 200% | 1,000,000 | 6,000 | 1,951 |

| 3 | 19,510 | 58,530 | 100 | 310 | 525 | 100% | 500,000 | 200% | 1,000,000 | 18,000 | 1,951 |

| 4 | 19,510 | 78,040 | 150 | 475 | 800 | 100% | 500,000 | 200% | 1,000,000 | 31,500 | 1,951 |

| 5 | 19,510 | 97,550 | 205 | 640 | 1,075 | 100% | 500,000 | 200% | 1,000,000 | 45,000 | 1,951 |

| 6 | 19,510 | 117,060 | 260 | 815 | 1,375 | 100% | 500,000 | 200% | 1,000,000 | 60,500 | 1,951 |

| 7 | 19,510 | 136,570 | 320 | 995 | 1,670 | 100% | 500,000 | 200% | 1,000,000 | 77,500 | 1,951 |

| 8 | 19,510 | 156,080 | 375 | 1,175 | 1,975 | 100% | 500,000 | 200% | 1,000,000 | 92,000 | 1,951 |

| 9 | 19,510 | 175,590 | 435 | 1,365 | 2,290 | 100% | 500,000 | 200% | 1,000,000 | 107,000 | 1,951 |

| 10 | 19,510 | 195,100 | 500 | 1,565 | 2,630 | 100% | 500,000 | 200% | 1,000,000 | 122,000 | 1,951 |

| 11 | 19,510 | 214,610 | 565 | 1,765 | 2,965 | 100% | 500,000 | 200% | 1,000,000 | 138,000 | 1,951 |

| 12 | 19,510 | 234,120 | 630 | 1,975 | 3,320 | 100% | 500,000 | 200% | 1,000,000 | 154,500 | 1,951 |

| 13 | 19,510 | 253,630 | 700 | 2,185 | 3,675 | 100% | 500,000 | 200% | 1,000,000 | 171,500 | 1,951 |

| 14 | 19,510 | 273,140 | 770 | 2,410 | 4,050 | 100% | 500,000 | 200% | 1,000,000 | 189,000 | 1,951 |

| 15 | 19,510 | 292,650 | 845 | 2,640 | 4,435 | 100% | 500,000 | 200% | 500,000 | 207,000 | 1,951 |

| .. | - | .. | .. | .. | .. | .. | .. | .. | .. | .. | - |

| .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | ||

| .. | .. | .. | .. | .. | .. | .. | .. | .. | .. | ||

| Age of 98 | 292,650 | 1,890 | 5,915 | 9,940 | 100% | 500,000 | 200% | 1,000,000 | 483,000 | ||

| Age of 99 | 292,650 | 1,885 | 5,900 | 9,910 | 100% | 500,000 | 200% | 1,000,000 | 500,000 | ||

| Total | 292,650 | 77,815 | 243,435 | 409,040 | - | - | - | - | - | 29,265 | |

- Annual cash return benefits and policy surrender value are based on the value calculated on policy anniversary.

- In the event of death, the benefit will be granted according to the life coverage in the table above or the accumulated actual life insurance premiums paid, whichever is higher.

Unit : Baht

| Summary of policy benefits (including dividends) | In case of no dividend payment | Examples of dividends from average return on investment throughout the contract(3) | |||||

|---|---|---|---|---|---|---|---|

| 3% | 4% | 5% | 3% | 4% | 5% | ||

| Dividends are not retained with the company | Dividends are retained with the company(4) | ||||||

|

500,000 | 500,000 | 500,000 | 500,000 | 500,000 | 500,000 | 500,000 |

|

- | 77,815 | 243,435 | 409,040 | 77,815 | 243,435 | 409,040 |

|

- | - | - | - | 21,555 | 67,425 | 113,300 |

|

500,000 | 577,815 | 743,435 | 909,040 | 599,370 | 810,860 | 1,022,340 |

|

292,650 | 292,650 | 292,650 | 292,650 | 292,650 | 292,650 | 292,650 |

|

207,350 | 285,165 | 450,785 | 616,390 | 306,720 | 518,210 | 729,690 |

|

29,265 | 29,265 | 29,265 | 29,265 | 29,265 | 29,265 | 29,265 |

|

236,615 | 314,430 | 480,050 | 645,655 | 335,985 | 547,475 | 758,955 |

(3) The company may consider paying dividends upon maturity to the insured from the 2nd policy anniversary onwards; such dividends are based on the return on investment of the assets of the dividend-paying product portfolio over the contract period after deducting all costs of the insurance policy. The company will allocate the 80 percent to the insured, and dividend at the maturity of this contract is different for each product. This is in accordance with the conditions, requirements, and dividend calculation methods provided by the company.

(4) In case of retaining dividends with the company, the insured will receive additional interest on the dividend amount. The above example is the case of maintaining annual dividends with the company every policy year from the 2nd policy anniversary until the maturity date. The company calculates the compounded interest rate at 1.0% per annum. However, the compounded interest rate is only an example of a calculation and not the interest rate guaranteed by the company, as it may be lower or higher than this example.

The average return on investment throughout the contract is only one factor used in the dividend calculation. The average return on investment over the contract shown is estimated from the company's average return on investment. The actual return on investment received may be higher or lower than what is shown. The insured should consider the information in the sales offering document before making a decision to purchase a life insurance policy.

The average return on investment over the contract period is the return that the company receives from the investment of the dividend-paying product assets over the contract period. The annual return on investment can be viewed via www.bangkoklife.com/parfund_ROI

Happy Whole Life (Par)*

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the coverage under the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part. Unless the insured does not have a stake in the assured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part, or if murdered by the beneficiary.

* Happy Whole Life (Par) consists of Happy Whole Life Insurance (Par) with premium payment terms of 5, 10, and 15 years and Happy Whole Life 9901 (Par) single premium, which are the marketing names for Prestige Life (Par) and Prestige Life (Par) single premium.

This extra coverage does not cover accidental deaths, resulting from the following cause or event that occur as follows:

- Acts of the insured while under the influence of alcohol, addictive substances, or narcotics to the extent that the insured is unable to control consciousness. In the case of a blood test, being "under the influence of alcohol" means having a blood alcohol level of 150 milligrams percent or higher.

- Commit suicide, attempted suicide, or self-inflicted injury

- While the insured is boarding, disembarking, or traveling in an aircraft that is not registered to carry passengers, and is not operated by a commercial airline

- While the insured participates in a brawl or takes part in provoking a brawl

- While the insured competes in a variety of races such as boat races, horse races, and ski races such as jet ski races, skate races, boxing, and parachute jumping (except survival parachute jumping)

- While taking off, landing, or traveling in a hot air balloon, or hang glider, bungee jumping, scuba diving with an air tank and underwater breathing apparatus

Note

- Information on the website is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exceptions can be inquired from your agents or from your life insurance policy details.

- Premium payment is the responsibility of the insured. Premium collection by life insurance agents and brokers is a service only

- The health declaration is one of the factors for underwriting and benefits payment consideration

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until maturity

- Premiums can be used for personal income tax deductions, according to the criteria set by the Revenue Department