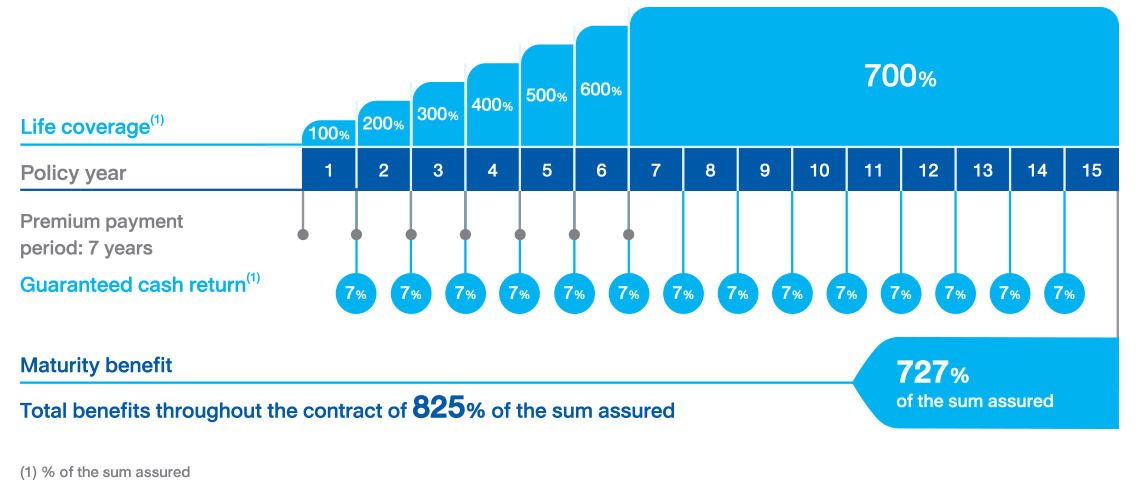

| Survival Benefits | Death Benefits |

|---|---|

| • On the 1st - 14th policy anniversary, receive 7% cash return | • The 1st policy year, receive 100% |

| • On the maturity date, receive 727% cash return | • The 2nd policy year, receive 200% |

| • Total benefits throughout the contract of 825% | • The 3rd policy year, receive 300% |

| • The 4th policy year, receive 400% | |

| • The 5th policy year, receive 500% | |

| • The 6th policy year, receive 600% | |

| • The 7th - 15th policy year, receive 700% | |

| (% of the sum assured) | |

Happy Saving 15/7

An endowment policy, build a stable life that meets your needs with comprehensive coverages and valuable benefits.

Newborn – 84

7 years

700%(1)

825%(1)

- Issued age: Newborn - 84 years

- Minimum sum assured: 50,000 baht

- Premium payment mode: Annually

- Underwriting is in accordance with the underwriting conditions of the company

- Additional riders can be purchased, according to the conditions set by the company

- In the case of not purchasing additional riders, no examination and no health questions are required

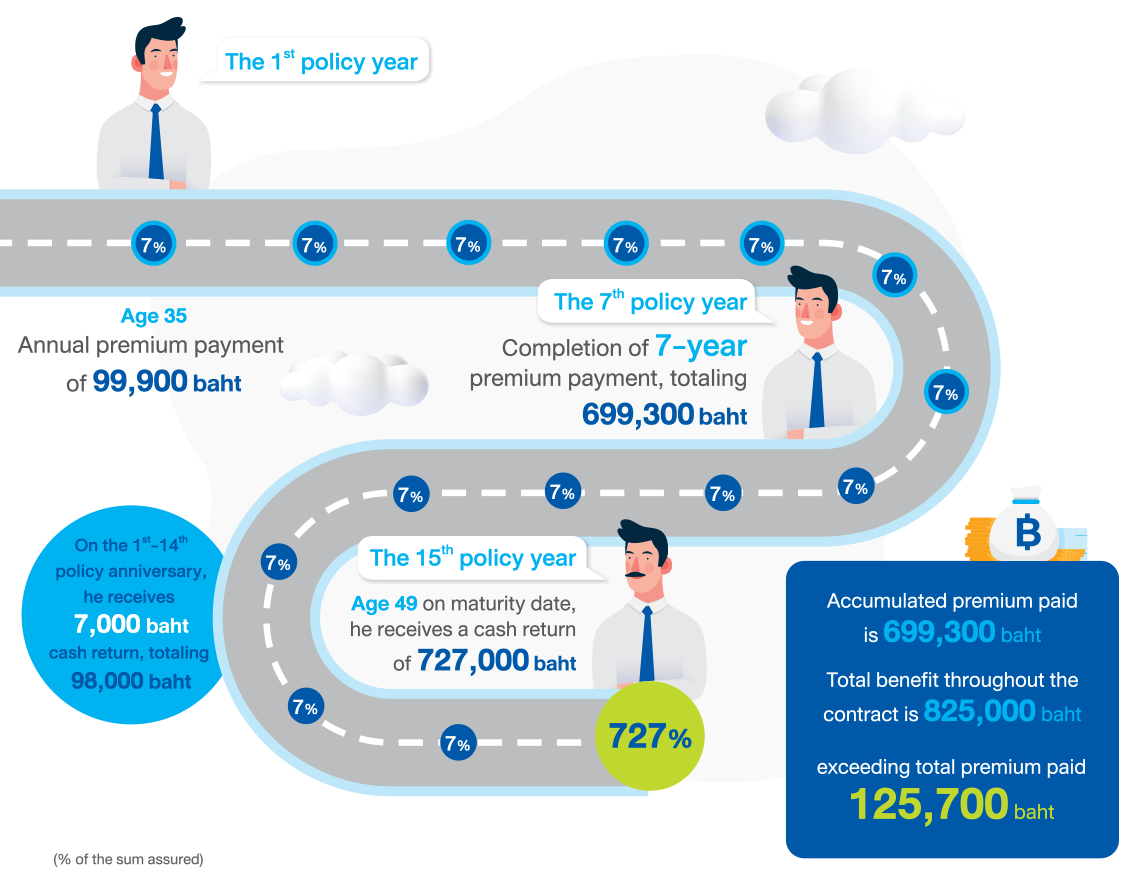

A 35-year-old male in good health would like to purchase a Happy Saving 15/7 with a 100,000 baht sum assured. He pays an annual premium of 99,900 baht and has a personal income tax rate of 20 percent throughout the contract period.

Unit: baht

| Policy Year | Annual premium (Beginning of policy year) |

Cash return benefit (At policy anniversary) | Life coverage | Cash surrender value | Total eligible cash return before maturity | Tax benefits | ||

|---|---|---|---|---|---|---|---|---|

| % of the sum assured | Amount | % of the sum assured | Amount | |||||

| 1 | 99,900 | 7% | 7,000 | 100% | 100,000 | 19,500 | 26,500 | 19,980 |

| 2 | 99,900 | 7% | 7,000 | 200% | 200,000 | 68,000 | 82,000 | 19,980 |

| 3 | 99,900 | 7% | 7,000 | 300% | 300,000 | 166,200 | 187,200 | 19,980 |

| 4 | 99,900 | 7% | 7,000 | 400% | 400,000 | 252,100 | 280,100 | 19,980 |

| 5 | 99,900 | 7% | 7,000 | 500% | 500,000 | 353,200 | 388,200 | 19,980 |

| 6 | 99,900 | 7% | 7,000 | 600% | 600,000 | 426,800 | 468,800 | 19,980 |

| 7 | 99,900 | 7% | 7,000 | 700% | 700,000 | 501,100 | 550,100 | 19,980 |

| 8 | - | 7% | 7,000 | 700% | 700,000 | 498,500 | 554,500 | - |

| 9 | - | 7% | 7,000 | 700% | 700,000 | 495,900 | 558,900 | - |

| 10 | - | 7% | 7,000 | 700% | 700,000 | 493,100 | 563,100 | - |

| 11 | - | 7% | 7,000 | 700% | 700,000 | 490,300 | 567,300 | - |

| 12 | - | 7% | 7,000 | 700% | 700,000 | 487,400 | 571,400 | - |

| 13 | - | 7% | 7,000 | 700% | 700,000 | 484,400 | 575,400 | - |

| 14 | - | 7% | 7,000 | 700% | 700,000 | 481,200 | 579,200 | - |

| 15 | - | 727% | 727,000 | 700% | 700,000 | 485,000 | 825,000 | - |

| Total | 699,300 | 825% | 825,000 | - | - | - | - | 139,860 |

- The value of cash return benefits, cash surrender value, and eligible cash return before maturity of the contract are based on the value calculated on policy anniversary

- The eligible cash return before maturity is the sum of the cumulative amount of received cash return and the amount of cash surrender value, calculated on policy anniversary. However, the insured will be assigned the cash surrender value only at the surrender date.

Unit : baht

| Summary of tax deduction benefits throughout the contract | Before tax deduction | After tax deduction | |||||

|---|---|---|---|---|---|---|---|

|

699,300 | 559,440 | |||||

|

98,000 | 98,000 | |||||

|

727,000 | 727,000 | |||||

|

825,000 | 825,000 | |||||

| Total benefit that exceeds the total premiums paid (4.-1.) | 125,700 | 265,560 | |||||

Secured Financial Planning for a Sustainable Future

Example A 35-year-old male in good health would like to purchase a Happy Saving 15/7 with a coverage period of 15 years and premium payment period of 7 years. His sum assured is 100,000 baht. He pays an annual premium of 99,900 baht and has a personal income tax rate of 20 percent throughout the contract period.

1. Living until the maturity date

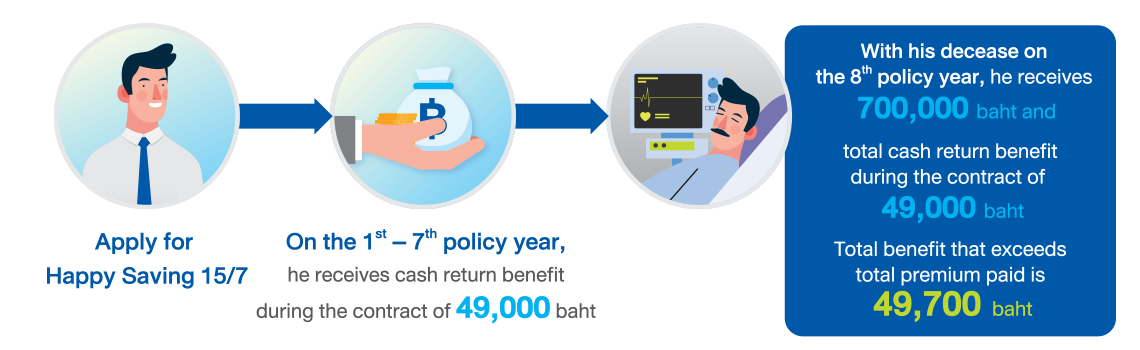

2. Death while the policy is effective (Example of death during the 8th policy year)

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part. Unless the insured does not have a stake in the insured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part, or if murdered by the beneficiary.

Note:

- Information on the website is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Premiums payment is the responsibility of the insured. Premium collection by life insurance agents and brokers is a service only

- A health declaration is one of the factors for underwriting and benefits payment consideration

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until its maturity

- Happy Saving 15/7 premium and health premium (if any) is eligible for tax deduction in accordance with the announcement from the Revenue Department

- Happy Saving 15/7 is a marketing name of BLA Happy Saving 15/7

For more details, please contact our life insurance agents or financial advisors nationwide.