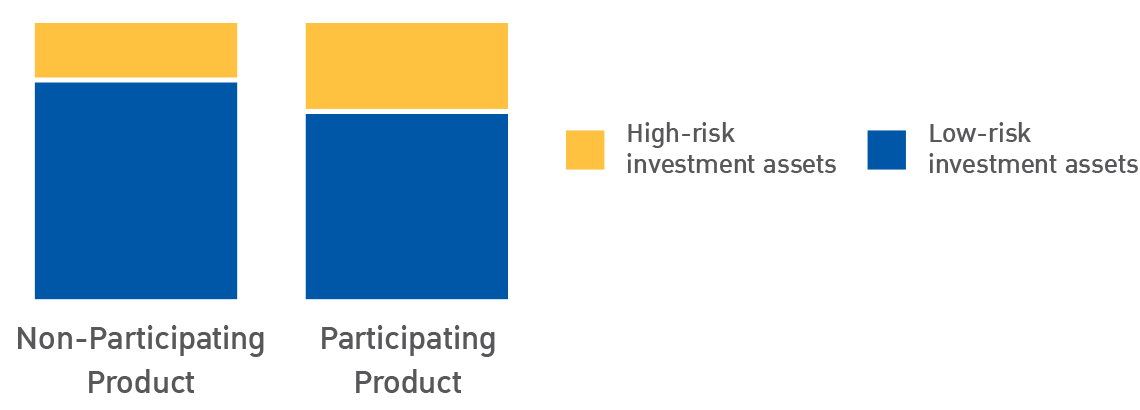

To meet the needs of planning in each aspect of life, the endowment insurance with Par is designed to improve your chances of generating higher returns with investment proportion in assets which are different from Non-Participating Product by increasing the investment proportion in high-risk assets along with managed with a dedicated investment portfolio. Expertise and efficiency for aiming in good and appropriate returns in each period.

Comparison of Investment Proportion between Non-Participating and Participating product

Investment Strengths

Separated investment portfolio*

Participating product portfolio provides investment flexibility for higher chance of receiving higher returns with minimum guarantee return

Bottom-Up analysis

For better investment decisions, this results in good and appropriate returns in each period of time

Manage and monitor investment portfolio

By experts and efficient management system

* To increase the opportunity to receive higher returns, the company has a policy to invest in high-risk assets for Participating Product in a higher proportion than Non-Participating Product. High-risk assets include common stocks and real estate funds both domestically and internationally, including businesses with long-term high growth prospects such as those in the technology and health sectors.

.png)

.png)

.png)

.png)

.png)