- Issued age: Newborn - 70 years

- Minimum sum assured: 100,000 baht

- Premium payment mode: Annually, semi-annually, quarterly, and monthly

- Health check-ups are in accordance with the company’s underwriting criteria

- Additional riders can be purchased according to the conditions set by the company

- Whole Life Sood Khoom consists of Happy Whole Life 99/20 life insurance contract, BLA ADB rider, BLA TPD rider and Waiver of premium (payer) rider (WP)

- The company offers BLA ADB rider and BLA TPD rider to the insured accepted at standard rates, or in accordance with the company’s underwriting guidelines

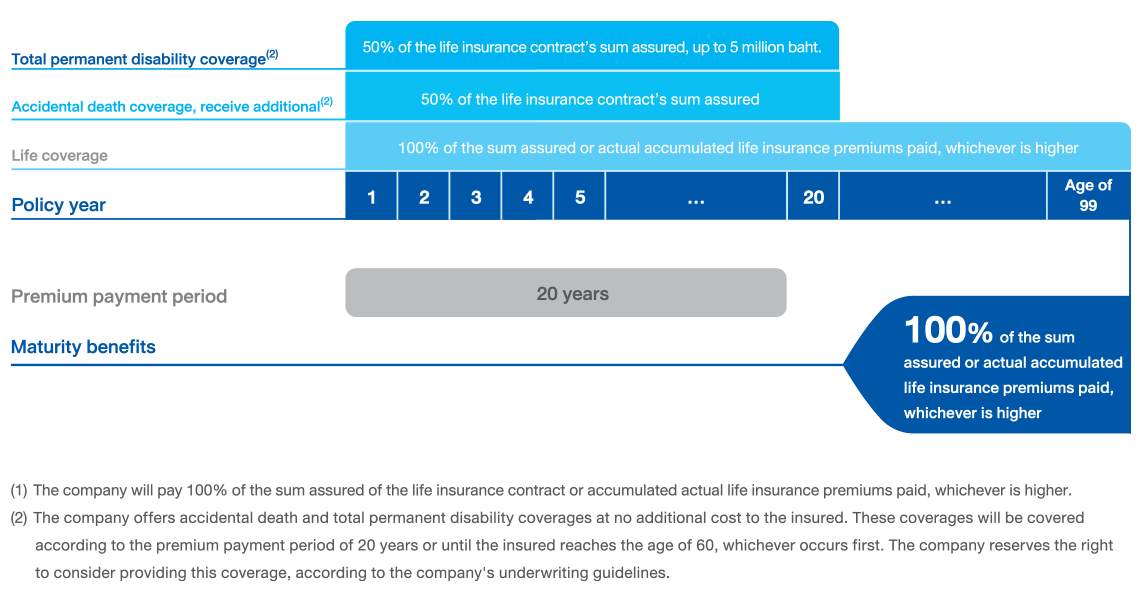

| Coverage | Benefits |

|---|---|

| 1. Non-accidental death |

|

| 2. Maturity benefits |

|

| Extra coverage | |

| 3. Accidental death |

|

| 4. Total permanent disability |

|

(1) These coverages will be covered according to the premium payment period of 20 years or until the insured reaches the age of 60, whichever occurs first. The company reserves the right to consider providing this coverage, according to the company's underwriting guidelines.

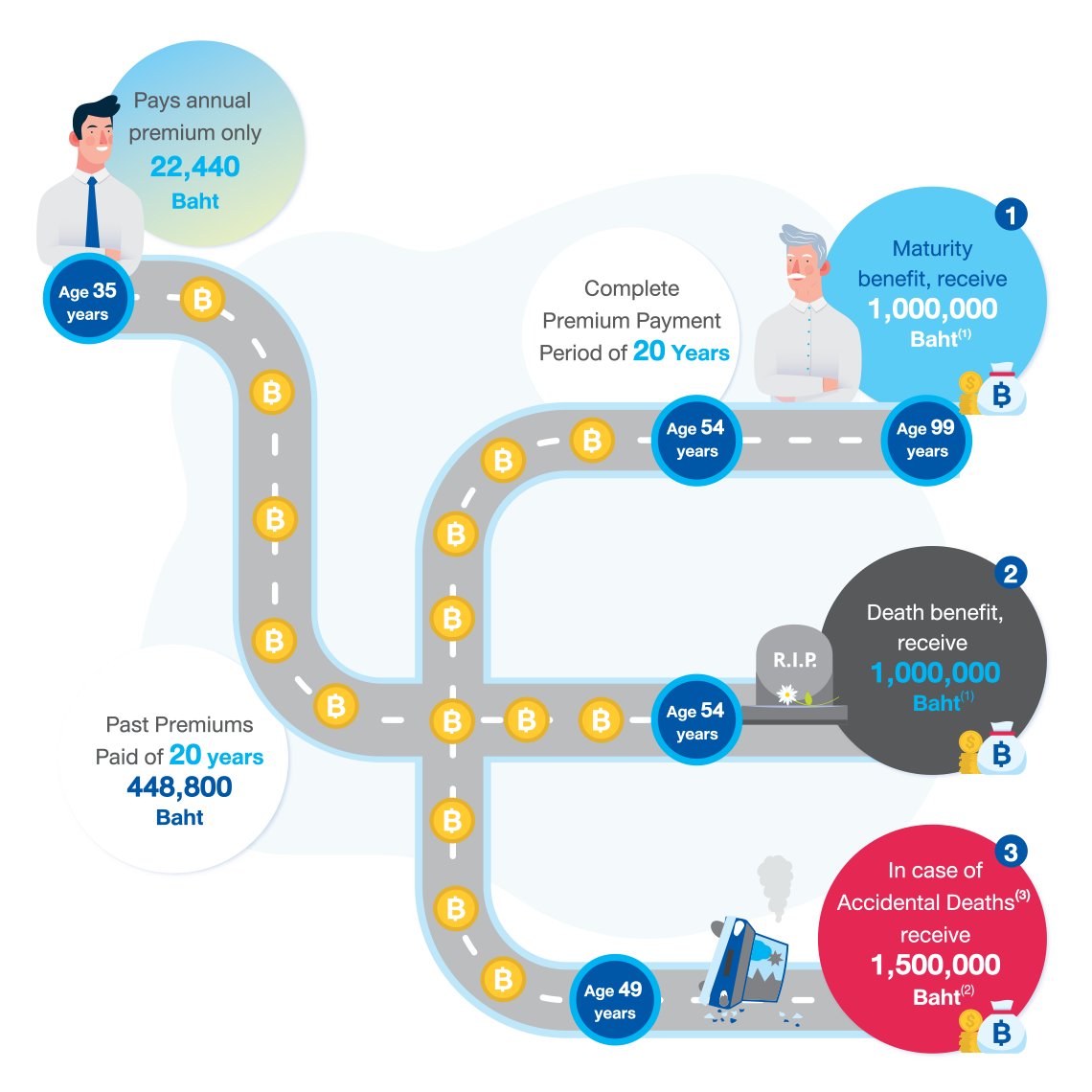

A 35-year-old male is seeking to build security for his family. He purchases a 1,000,000 baht sum assured of Whole Life Sood Khoom with a coverage period up to the age of 99 and premium payment period of 20 years. He pays an annual premium of 22,440 baht.

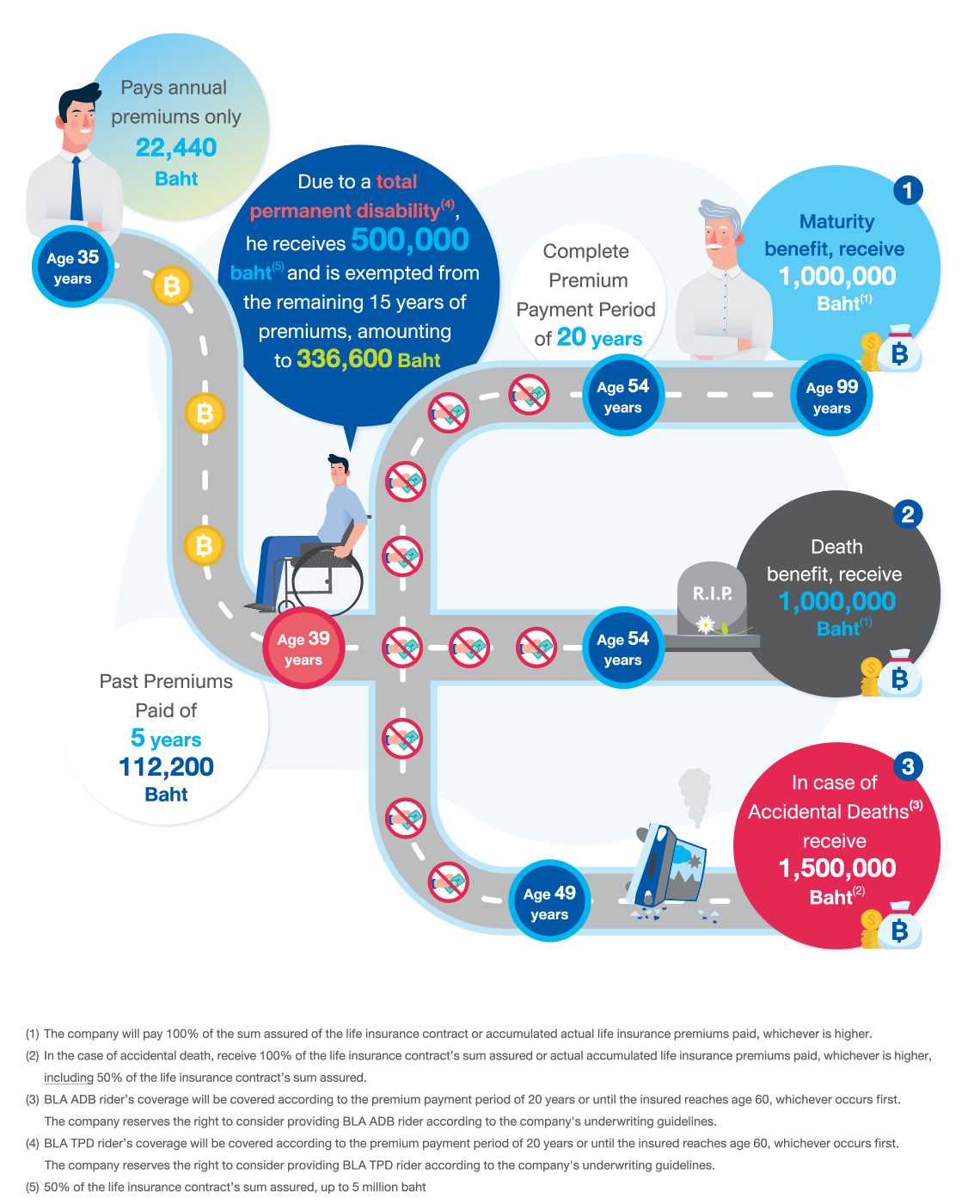

A 35-year-old male is seeking to build security for his family. He purchases a 1,000,000 baht sum assured of Whole Life Sood Khoom with a coverage period up to the age of 99 and premium payment period of 20 years . He pays an annual premium of 22,440 baht.

Happy Whole Life 99/20

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the coverage under the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum insured only for the additional part. Unless the insured does not have a stake in the insured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum insured only for the additional part, or if murdered by the beneficiary.

BLA ADB Rider

This rider will not cover any losses or damages incurred in time or as a result of any of the following causes:

- While the insured is riding or traveling on a motorcycle

- Injury sustaining while the insured is under the influence of alcohol, addictive substances, or narcotics drugs to the extent that the persons faculties to operate are materially and appreciably impaired. The term "under the influence of alcohol" in the case of having a blood test refers to a blood alcohol level of 150 milligrams percent or over.

- Commit suicide, attempted suicide, or self-inflicted injury

- While the insured engaging in all kinds of motor or boat racing, horse racing, and skiing such as jet skiing, skating, boxing, and parachute jumping (except to save life), while boarding or alighting from or traveling as a passenger in a balloon, or glider, bungee jump, diving with scuba tank and device

- Back pain due to herniated disc, spondylolisthesis, degeneration, or spondylosis, spondylitis, and spondylolysis excepts the fracture or dislocation of spine occurring due to an accident

BLA TPD Rider

The rider’s coverage does not cover any losses or damages incurred in time or as a result of any of the following causes:

- Commit suicide, attempted suicide, or self-inflicted injury

- Injury sustaining while the insured is under the influence of alcohol, addictive substances, or narcotics drugs to the extent that the persons faculties to operate are materially and appreciably impaired. The term "under the influence of alcohol" in the case of having a blood test refers to a blood alcohol level of 150 milligrams percent or over.

- Injuries sustaining while the insured is boarding, or alighting from traveling as a passenger in an aircraft that is not licensed for carrying passengers, and is not operated by a commercial airline

- Injuries sustaining while the insured is operating or servicing as a crewmember in any aircraft

- While the insured serves in the military, police force, or volunteer and joining the war or suppression operation

- Injuries sustaining by the insured while the insured is committing a felony or while under arrest by or escaping arrest of authorities

- War (declared or undeclared), aggression or acts of foreign enemies civil war, revolution, rebellion, or terrorism

Note

- Information on the website is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Premium payment is the responsibility of the insured. Premium collection by life insurance agents and brokers is a service only

- A health declaration is one of the factors for underwriting or benefits payment consideration

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until maturity

- Life insurance premiums can be used as a personal income tax deduction according to the criteria set by the Revenue Department