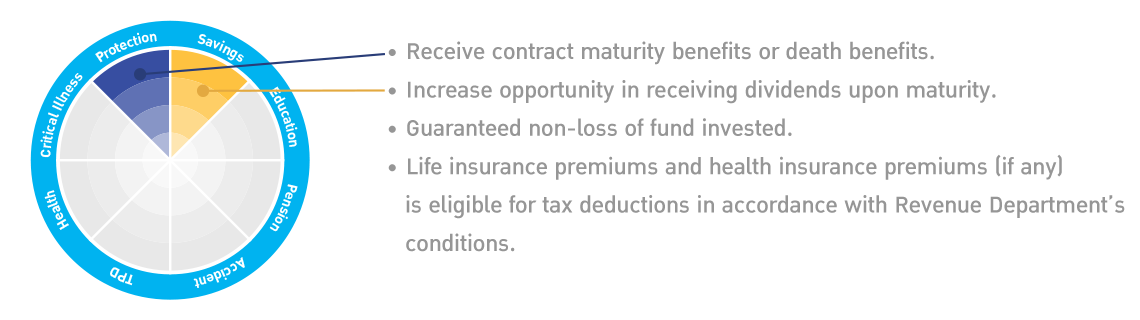

This Participating Endowment Life Insurance Plan is Suitable for…

- Life planning to create assurance and security for the future

- Investment planning for better returns and no loss of fund invested

- Child education planning-family planning for the education of your loved ones

- Tax-reduction planning where life assurance premiums are tax-exempted

- Business planning for your business expansion

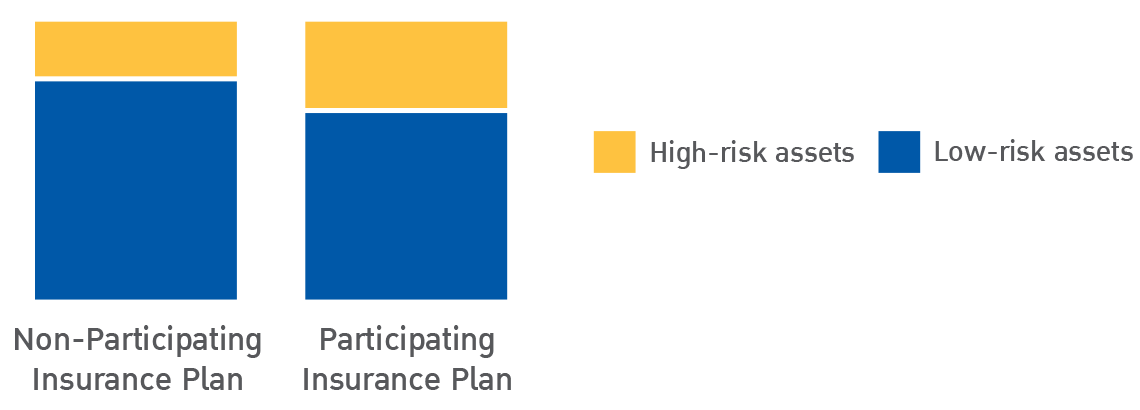

To meet the needs in planning each aspect of life, participating endowment life insurance has therefore been designed to increase the opportunity of creating higher returns, with proportions of the investment being in assets that are different from those of insurances in general. The increased proportions are invested in high-risk assets and managed by specific investment portfolio with high competence and efficiency and an aim in getting good and appropriate returns at each period.

Comparison of Non-Participating and Participating Insurance Plan Asset Mix

Investment Strengths

Specific Investment Portfolio*

Participating Life Insurance Product Groups bring flexibility to investment as you will get opportunities for higher returns while still receiving guaranteed minimum returns.

Analyzing asset information as a principle

To support bottom up investment decision to receive good and appropriate returns at each period.

Manage and follow up the investment

By skillful investment management team and a highly efficient management system

* The Company has a policy to invest in high-risk assets for participating life insurance plans at a higher proportion than for non-participating life insurance plans; these high-risk assets include ordinary shares and real estate investment trusts both domestic and overseas which compose of business with high growth trends in the long run such as technology and healthcare groups in order to increase the opportunities for getting higher returns.

Starting a new family can be exciting but worrying at the same time, but with good planning, you and your loved one can pass through this period together with greater happiness in the future.

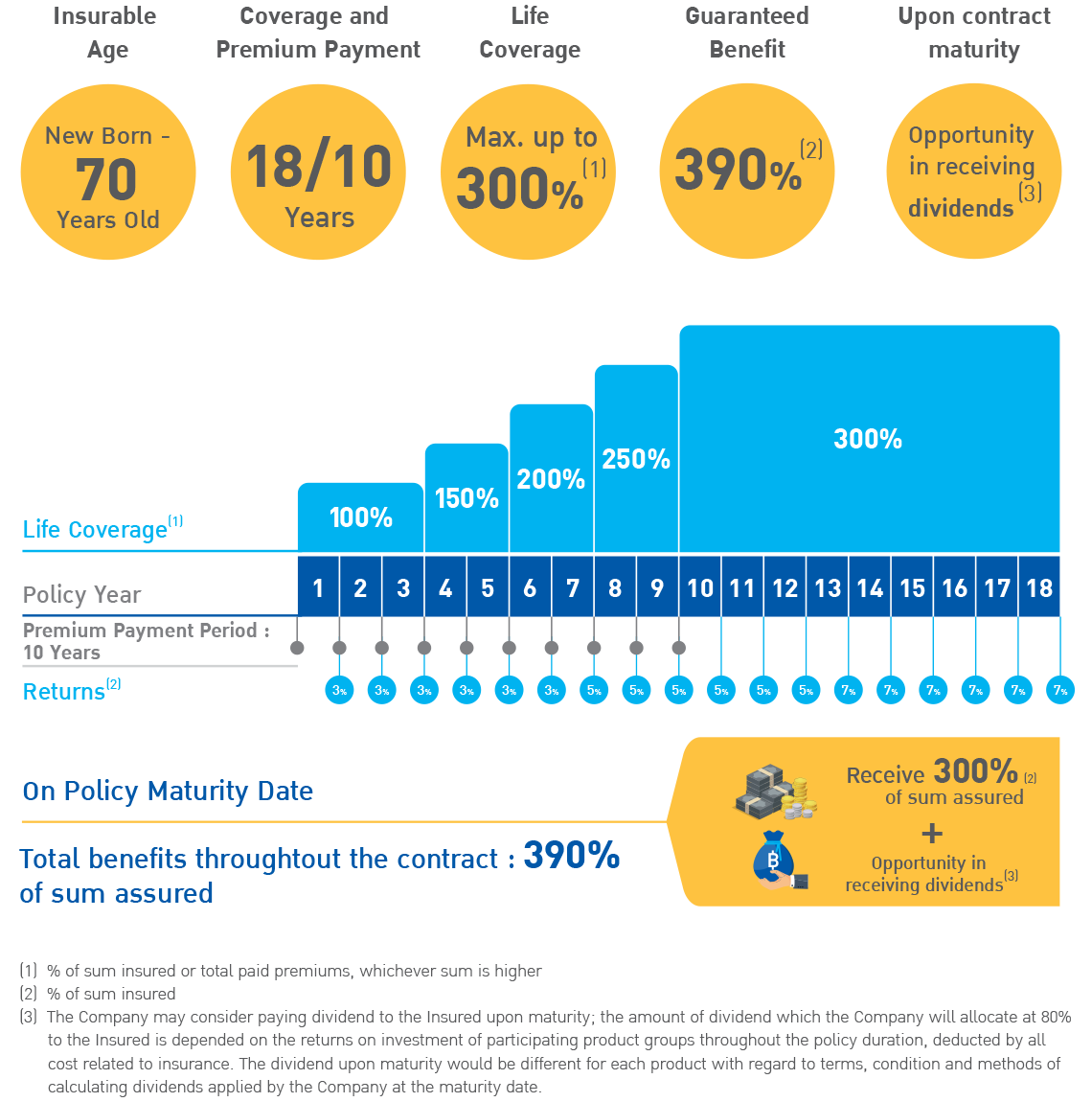

Introducing a perfect family-starting plan, “BLA HAPPY SAVING 18/10 (Par)” where you pay premium for 10 years and receive 18 years of life coverage while saving up for the future of your family with an opportunity of receiving dividends.

- Insurable age : Newborn – 70 years

- Minimum sum assured 50,000 baht

- Premium payments: annually, semiannually, quarterly, or monthly

- Health declaration is one factor in underwriting process or consideration of benefit payment

- Medical examination is according to the Company’s underwriting principles

- Supplementary contracts can be purchased according to conditions stipulated by the Company

| Survival Benefits | Death Benefits: If the Insured dies |

|---|---|

| The Insured will receive 3% return on the 1st to 6th policy anniversary | During the 1st – 3rd policy years, the Company will pay 100% |

| The Insured will receive 5% return on the 7th to 12th policy anniversary | During the 4th – 5th policy years, the Company will pay 150% |

| The Insured will receive 7% return on the 13th to 18th policy anniversary | During the 6th – 7th policy years, the Company will pay 200% |

| The Insured will receive 300% return on maturity | During the 8th – 9th policy years, the Company will pay 250% |

| Total survival benefits throughout the contract: 390% | During the 10th – 18th policy years, the Company will pay 300% |

| Plus the opportunity of receiving dividends according | |

| to the Company’s policy[3] | |

| (% of sum assured) | (% of the sum assured or total paid premiums, whichever sum is higher) |

The Applicant is a 40-year-old male, in good health, sum assured 100,000 baht

Annual premium is 35,200 baht, with 20% personal income tax rate throughout the Contract duration.

Unit: Baht

| Policy Year | Annual Premium (At the beginning of policy year) |

Return on policy anniversary | Life Coverage | Cash Surrender Value | Total return before Maturity | Tax deductible benefit | ||

|---|---|---|---|---|---|---|---|---|

| % of Sum Assured | Baht | % of Sum Assured | Baht | |||||

| 1 | 35,200 | 3% | 3,000 | 100% | 100,000 | 1,900 | 4,900 | 7,040 |

| 2 | 35,200 | 3% | 3,000 | 100% | 100,000 | 21,900 | 27,900 | 7,040 |

| 3 | 35,200 | 3% | 3,000 | 100% | 100,000 | 55,700 | 64,700 | 7,040 |

| 4 | 35,200 | 3% | 3,000 | 150% | 150,000 | 86,300 | 98,300 | 7,040 |

| 5 | 35,200 | 3% | 3,000 | 150% | 150,000 | 122,900 | 137,900 | 7,040 |

| 6 | 35,200 | 3% | 3,000 | 200% | 200,000 | 150,500 | 168,500 | 7,040 |

| 7 | 35,200 | 5% | 5,000 | 200% | 200,000 | 178,900 | 201,900 | 7,040 |

| 8 | 35,200 | 5% | 5,000 | 250% | 250,000 | 207,900 | 235,900 | 7,040 |

| 9 | 35,200 | 5% | 5,000 | 250% | 250,000 | 237,700 | 270,700 | 7,040 |

| 10 | 35,200 | 5% | 5,000 | 300% | 300,000 | 268,300 | 306,300 | 7,040 |

| 11 | 5% | 5,000 | 300% | 300,000 | 271,800 | 314,800 | ||

| 12 | 5% | 5,000 | 300% | 300,000 | 275,500 | 323,500 | ||

| 13 | 7% | 7,000 | 300% | 300,000 | 279,300 | 334,300 | ||

| 14 | 7% | 7,000 | 300% | 300,000 | 283,200 | 345,200 | ||

| 15 | 7% | 7,000 | 300% | 300,000 | 287,200 | 356,200 | ||

| 16 | 7% | 7,000 | 300% | 300,000 | 291,300 | 367,300 | ||

| 17 | 7% | 7,000 | 300% | 300,000 | 295,600 | 378,600 | ||

| 18 | 307% | 307,000 | 300% | 300,000 | 300,000 | 390,000 | ||

| รวม | 352,000 | 390% | 390,000 | - | - | - | - | 70,400 |

- Benefits of Returns, Cash Surrender Value, and Total return before Maturity, are calculated as at Policy anniversary.

- Total return before Maturity means accumulated anniversary return plus cash surrender value calculated at that policy anniversary. Remark that at the policy surrender date the Insured will receive only the cash surrender value.

Unit: Baht

| Policy Benefits (include dividends) | In case no dividends are paid | Sample of dividends payment based on average investment return throughout contract period[3] | ||

|---|---|---|---|---|

| 3% | 4% | 5% | ||

| 1. Total return on 1st to 18th policy anniversary | 90,000 | 90,000 | 90,000 | 90,000 |

| 2. Return on maturity at 18th policy year | 300,000 | 300,000 | 300,000 | 300,000 |

| 3. Opportunity in receiving dividends upon maturity[3] | - | 34,050 | 66,140 | 98,220 |

| 4. Total benefits throughout the contract (1.+2.+3.) | 390,000 | 424,050 | 456,140 | 488,220 |

| 5. Accumulated Premium paid for 10 years | 352,000 | 352,000 | 352,000 | 352,000 |

| 6. Total benefits more than premium paid (4.-5.) | 38,000 | 72,050 | 104,140 | 136,220 |

| 7. Tax deductible benefit for 10 years | 70,400 | 70,400 | 70,400 | 70,400 |

| 8. Total benefits more than premium paid [Include tax deductible benefit (6.+7.)] |

108,400 | 142,450 | 174,540 | 206,620 |

[3] The Company may consider paying dividend to the Insured upon maturity; the amount of dividend which the Company will allocate at 80% to the Insured is depended on the returns on investment of participating product groups throughout the policy duration, deducted by all cost related to insurance. The dividend upon maturity would be different for each product with regard to terms, condition and methods of calculating dividends applied by the Company at the maturity date.

Samples of coverage exclusions BLA HAPPY SAVING 18/10 (Par)

- In the event of non-disclosure or misrepresentation, the Company will terminate the contract within 2 years of the inception date of the coverage as per the insurance policy or policy renewal date or the reinstatement date or the date the Company had approved an additional sum assured just for the additional sum, except if the Insured does not have any insurable interest; or there was misstatement of age so that the actual age is outside the premium rate limit according to the normal business practice of the Company.

- Suicide within 1 year from inception date of the coverage or policy renewal or reinstatement date or the date the Company approved the increase of the sum assured just at the increased part, or is murdered by the beneficiary.

Remarks:

- This sales illustration serves only to summarize the initial benefits. Please read the details and conditions of the coverage and exclusions before deciding on taking out an insurance. The complete term and conditions can be enquire from your agent or details as specified in the policy.

- Policyholder is responsible for Premium payment; collection of premiums by agent/broker is just service rendered.

- Health declaration is one factor in underwriting or payment consideration under the insurance contract.

- To ensure maximum benefits from the Policy, the Insured should make premium payments throughout the duration of the premium payments and hold the Policy until contract maturity.

- Life insurance premiums of BLA HAPPY SAVING 18/10 (Par) and health insurance premiums (if any) is eligible for tax deductions in accordance with Revenue Department’s conditions.