- Issued age: Newborn to 14 years old

- Coverage period until age of 99 and premium payment period of 20 years

- Minimum sum assured: 150,000 baht

- Premium payment mode: annually, semi-annually, quarterly, and monthly

- Health examinations are in accordance with the company's underwriting criteria

- Additional riders can be purchased, according to the conditions set by the company

- The company will provide free insurance coverage according to BLA Payor Protect rider for premium payers who have the Payer’s Benefit (PB) rider at the standard premium rate. In addition, this is subject to Company's underwriting guidelines.

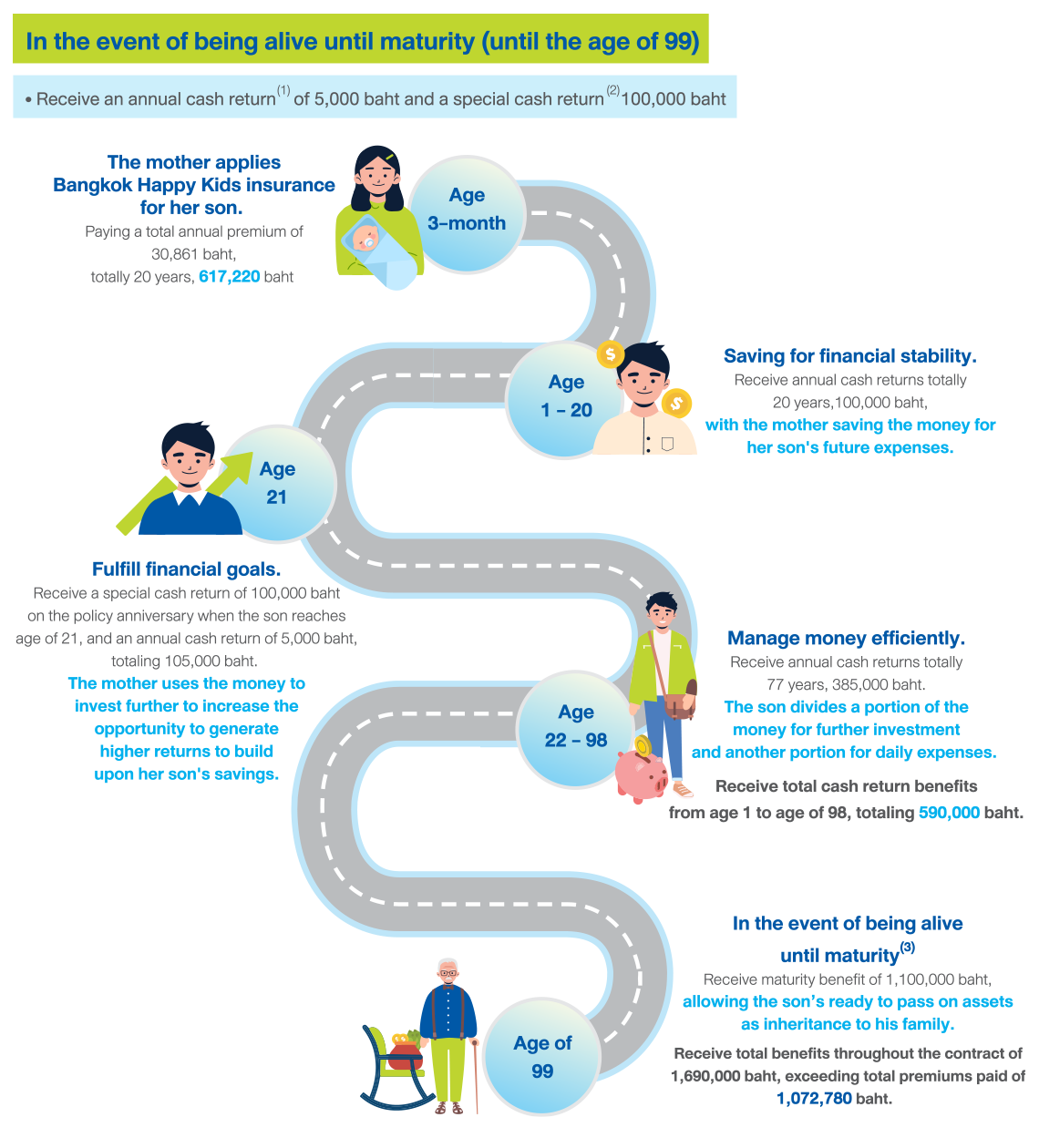

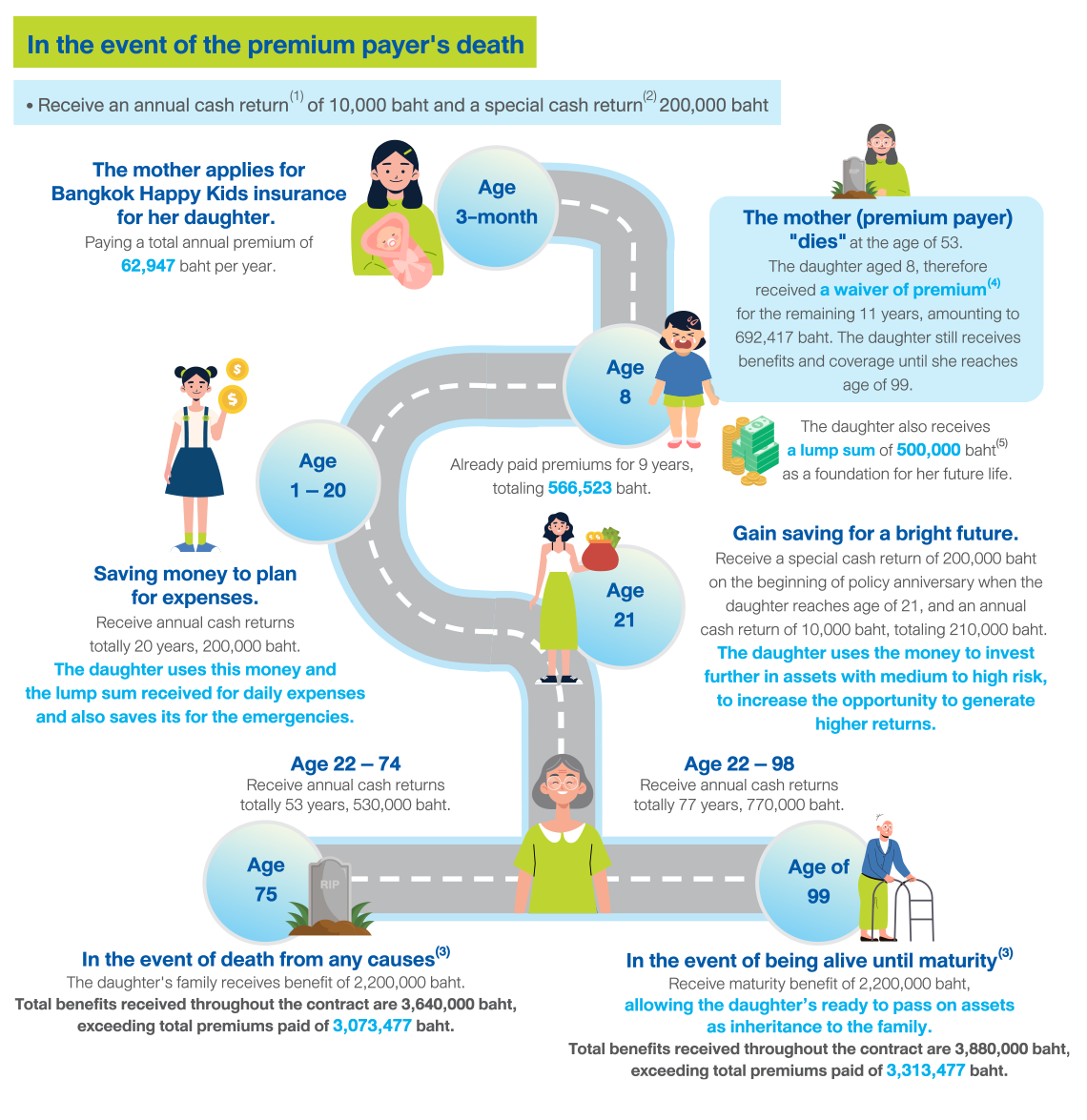

A whole life insurance policy that meets all of your child's life planning needs, covering both life protection and financial security. Guaranteed annual cash returns throughout the contract, enhanced worthiness with special cash returns, and receive coverage for the premium payer, giving you confidence in every life situation and worries free about your child’s future.

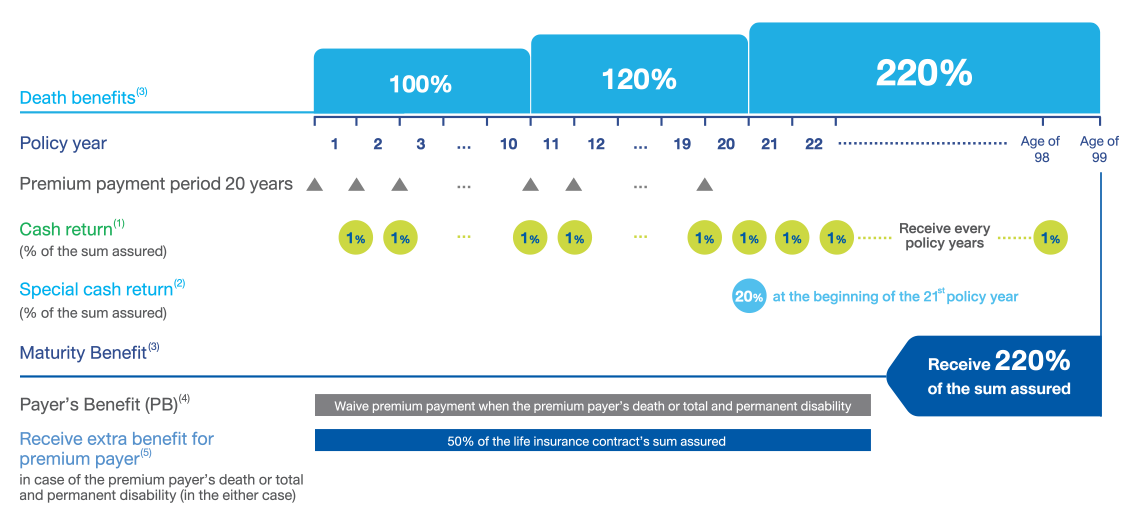

Guaranteed annual cash returns of 1%(1) to serve as another source of savings in the form of life insurance for your child, to be used for daily expenses or accumulated for future investment.

Worthy with a lump sum from a special cash return of 20%(2) to enhance financial security and build a bright future for your child. Upon maturity, receive another lump sum of 220%(3) to help your child achieve their financial goals.

Your child receives life protection from new born up to age of 99, with increasing coverage in the 11th and 21st policy years, receiving maximum coverage up to 220%(3) for death from any causes

Receive additional benefits for the premium payer of 50%(4) in the event of the premium payer's death or total and permanent disability, allowing you to cope with life’s uncertainties and worries free about your child in your absence.

Deliver your love to your child through the Bangkok Happy Kids insurance plan, available from new born, to provide a strong foundation for their future.

((1) In case survival, receive annual cash return of 1% of the sum assured of the Bangkok Happy Kids 99/20 life insurance contract on the policy anniversary from the 1st policy year until the policy anniversary when the insured turns age of 98.

(2) In case survival, receive a special cash return of 20% of the sum assured of the Bangkok Happy Kids 99/20 life insurance contract at the beginning of the 21st policy year.

(3) The company will pay % of the sum assured or the actual accumulated life insurance premiums paid, minus all annual cash returns and special cash return already paid by the company (if any), whichever is higher, of the Bangkok Happy Kids 99/20 life insurance contract.

(4) The company will provide free insurance coverage according to BLA Payor Protect rider to the payer in the event of either death or total and permanent disability, which the Company will pay an amount equal to 50% of the Bangkok Happy Kids 99/20 life insurance contract's sum assured. The coverage will be provided for the duration of premium payment period of life insurance or until the policy anniversary at which the Insured (Minor) reaches the age of 21, or until the policy anniversary at which the payer reaches the age of 65, whichever comes first. The Company will provide coverage according to this rider to the premium payer covered by the Payer's Benefit (PB) rider at the standard premium rate. In addition, the Company reserves the right to consider providing coverage, according to the Company's underwriting guidelines.