- Issued age: Newborn to 70 years

- Coverage period until the age of 99 and premium payment period 9 years

- Happy Saving 999 consists of Happy Saving 999 life insurance contract Plan A or Plan B and BLA ADB 999 rider

- Happy Saving 999 Plan A life insurance contract for the sum assured of 100,000 to 299,999 baht

- Happy Saving 999 Plan B life insurance contract for the sum assured of 300,000 baht and above

- BLA ADB 999 rider: Equals to the sum assured of Happy Saving 999 Plan A or Plan B life insurance contract. When combining the total amount of sum assured of all BLA ADB 999 riders and BLA ADB riders must not exceed a maximum of 10 million baht.

- Premium payment mode: Annually, semi-annually, quarterly, and monthly

- In case of purchasing riders: Health check-ups are required in accordance with the rider's requirements

- In case of not purchasing riders: No health check-ups are required, only answering the short health questions

- The company provides coverage for BLA ADB 999 rider without charging a premium for the insured whom the company insures at a standard rate, subject to the company’s underwriting criteria

Fulfill life with happiness, receive annual cash returns, enhance worthiness with special cash returns, receive life and accident coverage throughout the contract to pass on stability and grow wealth for you and your loved ones

to create a continuous stream of passive income

Guaranteed annual cash returns of 9%(1) for savings or daily expenses purposes

to fulfill all future goals

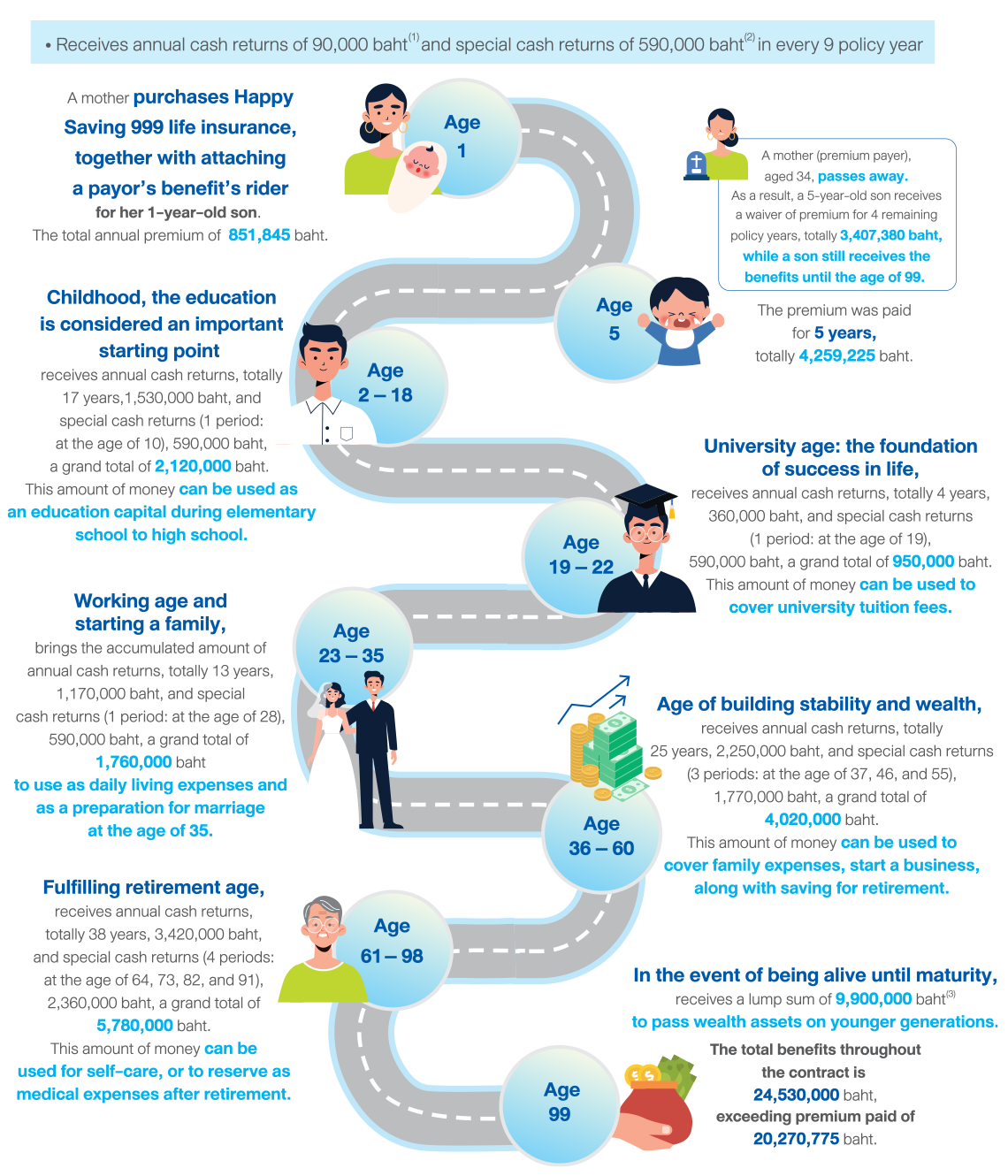

Enjoy worthiness with special cash returns(2) of 39% or 59% in every 9 policy year and receive a lump sum of 990%(3) to meet financial planning in every life stage

to represent love and care for your loved ones when you pass away

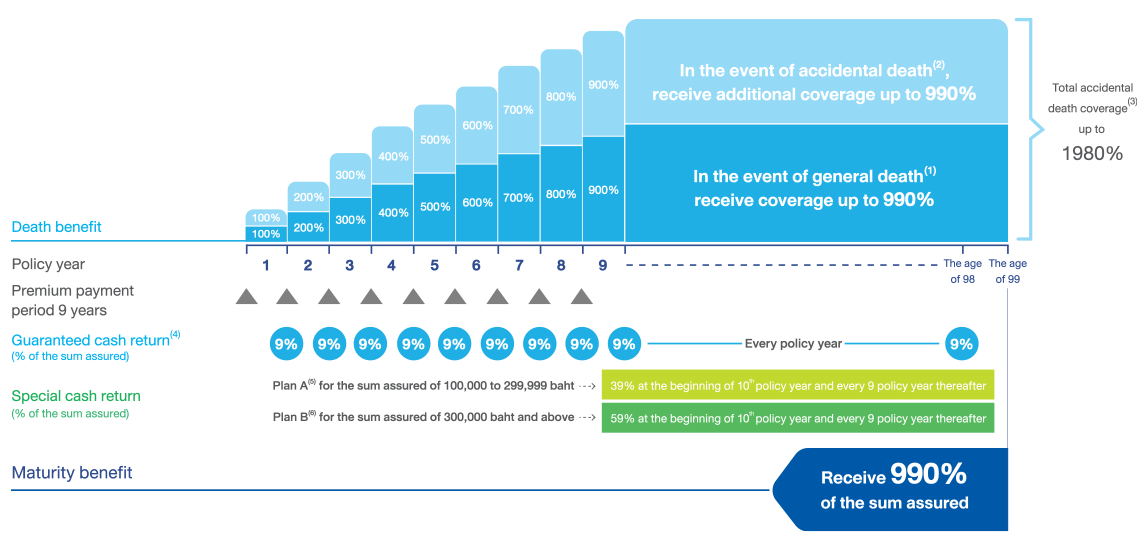

Feel peace of mind with high life coverage from newborn to the age of 99, increasing over time. In the event of general death(4), receive coverage up to 990%. In the event of accidental death(5), receive coverage up to 1980%

to provide to your little ones over a lifetime

Be able to purchase Happy Saving 999 life insurance, together with payor’s benefit rider for your little ones since newborn to be a good life foundation for his/her future

Life insurance premium is eligible for tax deduction in accordance with the announcement from the Revenue Department

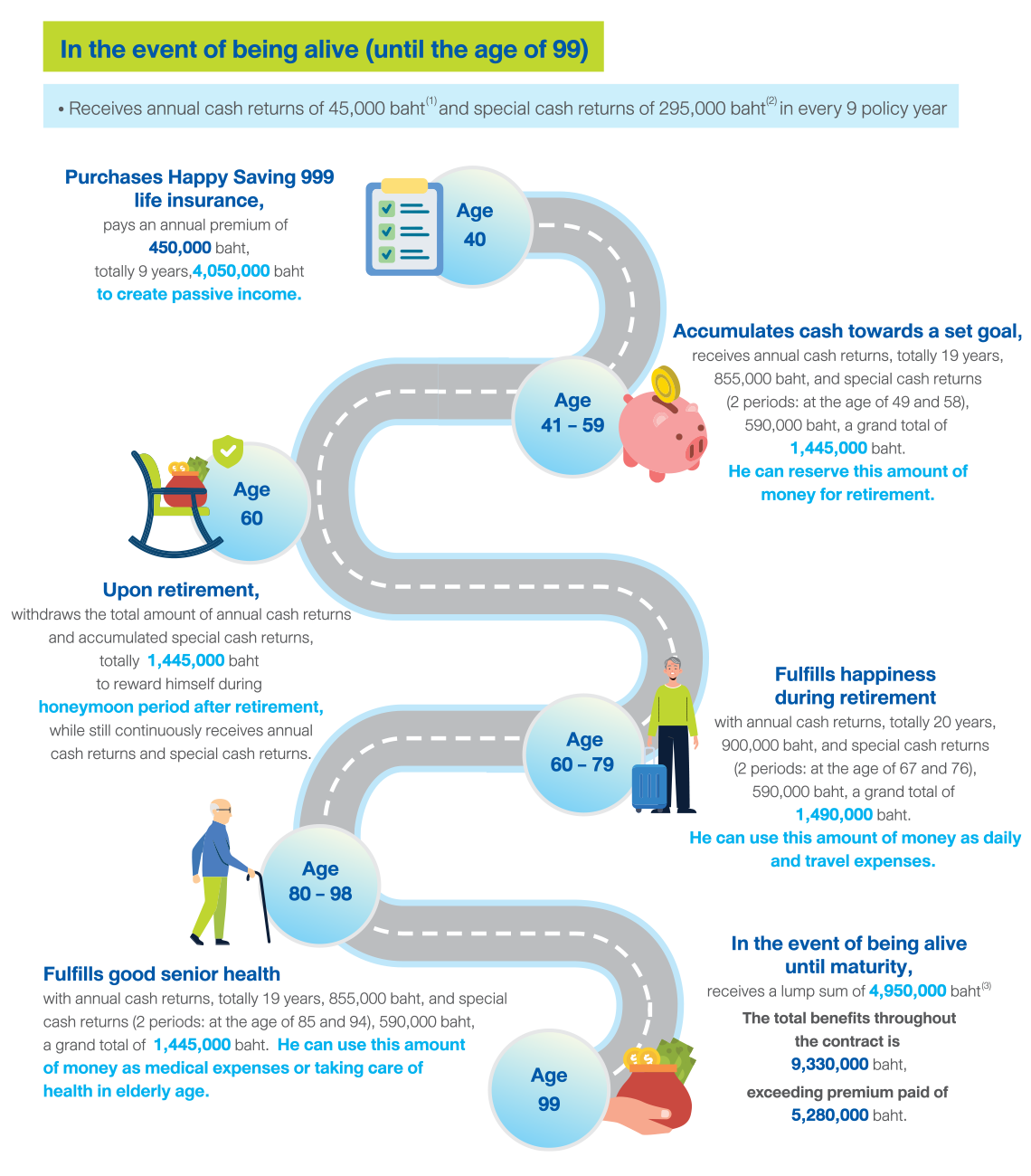

(1) In the event of being alive, receives annual cash returns of 9% of the sum assured of Happy Saving 999 Plan A or Plan B life insurance contract.

(2) In the event of being alive, receives special cash returns of 39% of the sum assured of Happy Saving 999 Plan A life insurance contract, or 59% of the sum assured of Happy Saving 999 Plan B life insurance contract at the beginning of 10th policy year and every 9 policy year thereafter, up to the policy year that the insured reaches the age of 98.

(3) In the event of being alive until maturity, receives a cash return of 990% of the sum assured of Happy Saving 999 Plan A or Plan B life insurance contract.

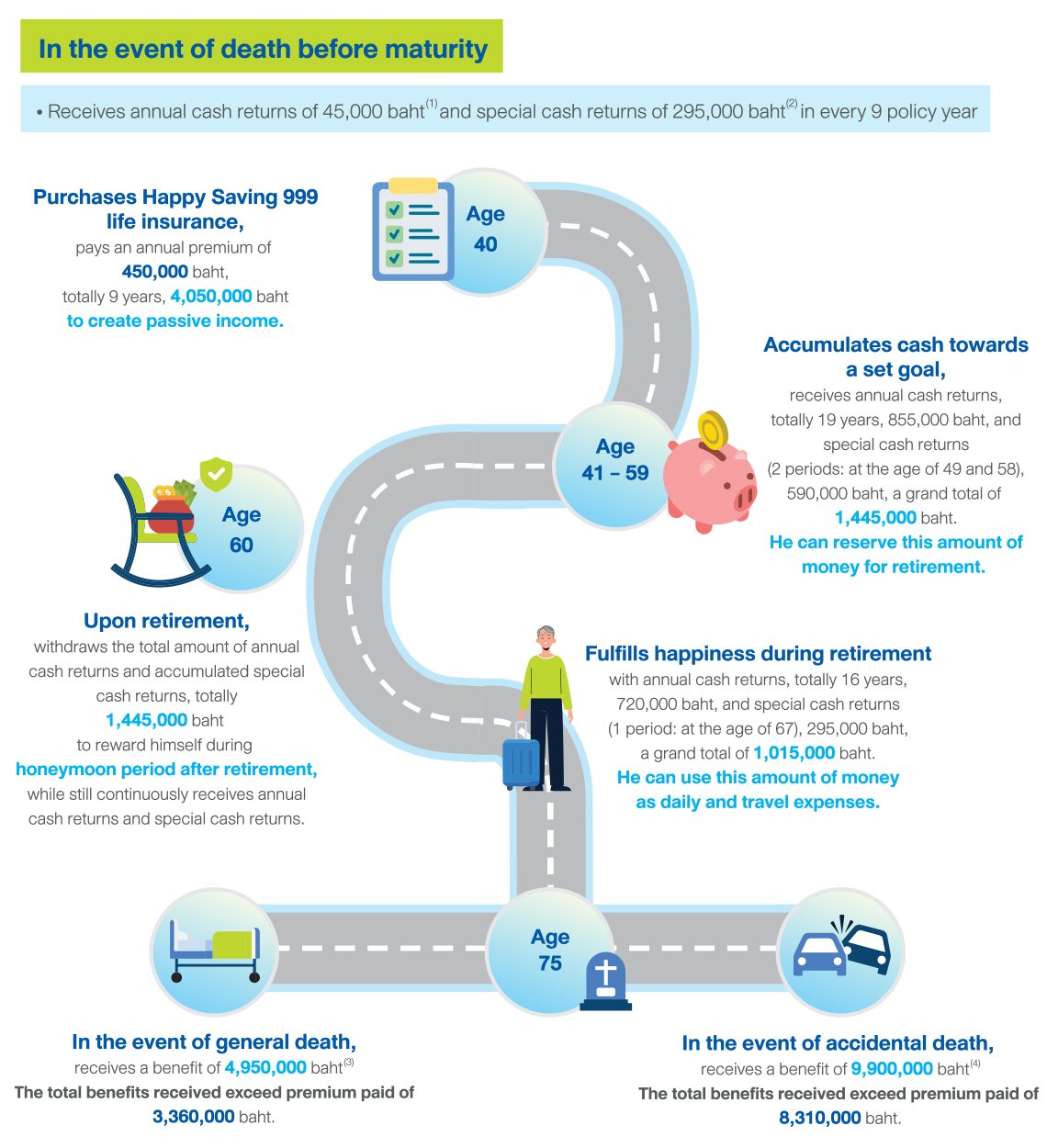

(4) The coverage for general death is calculated as a percentage of the sum assured or the actual accumulated life insurance premium paid, whichever is higher, under Happy Saving 999 Plan A or Plan B life insurance contract.

(5) The coverage for accidental death is calculated as a percentage of the sum assured or the actual accumulated life insurance premium paid, whichever is higher, under Happy Saving 999 Plan A or Plan B life insurance contract, plus a percentage of the sum assured of BLA ADB 999 rider. When combining the total amount of sum assured of all BLA ADB 999 riders and BLA ADB riders must not exceed a maximum of 10 million baht.

(1) The company will pay a percentage of the sum assured or the actual accumulated life insurance premium paid, whichever is higher, under Happy Saving 999 Plan A or Plan B life insurance contract.

(2) The company will pay a percentage of the sum assured of BLA ADB 999 rider equivalent to the sum assured of Happy Saving 999 Plan A or Plan B life insurance contract. When combining the total amount of sum assured of all BLA ADB 999 riders and BLA ADB riders must not exceed a maximum of 10 million baht.

(3) The maximum of total coverage due to accidental death is calculated as a percentage of the sum assured or the actual accumulated life insurance premium paid, whichever is higher, under Happy Saving 999 Plan A or Plan B life insurance contract, plus a percentage of the sum assured of BLA ADB 999 rider. When combining the total amount of sum assured of all BLA ADB 999 riders and BLA ADB riders must not exceed a maximum of 10 million baht.

(4) In the event of being alive, receives annual cash returns of 9% of the sum assured of Happy Saving 999 Plan A or Plan B life insurance contract, from the 1st policy anniversary to the policy anniversary that the insured reaches at the age of 98.

(5) In the event of being alive, receives special cash returns of 39% of the sum assured of Happy Saving 999 Plan A life insurance contract, at the beginning of 10th policy year and every 9 policy year thereafter, up to the policy year that the insured reaches the age of 98.

(6) In the event of being alive, receives special cash returns of 59% of the sum assured of Happy Saving 999 Plan B life insurance contract, at the beginning of 10th policy year and every 9 policy year thereafter, up to the policy year that the insured reaches the age of 98.