Unit: Baht

| Benefits | Plan 2000 | Plan 3000 | Plan 4000 | Plan 5000 | |

|---|---|---|---|---|---|

| 1. In-patient benefits | |||||

| Group 1 | Hospital daily room & board, food and hospital service charges (in-patient) per confinement, not exceeding 125 days | 2,000 per day | 3,000 per day | 4,000 per day | 5,000 per day |

| In the event of ICU, such benefit will be paid for hospital daily room & board, food and hospital service charges (in-patient), will be twice paid for a maximum of 15 days, total benefit under Group 1 must not exceed 125 days | |||||

| Group 2 | Fees for medical service, diagnosis, treatment, blood services, nurse services, medicine, intravenous nutrient, and medical supplies, per confinement | Must not exceed 25,000 with all Group 2 benefits combined | Must not exceed 30,000 with all Group 2 benefits combined | Must not exceed 200,000 with all Group 2 and Subgroup 4.1-4.4 benefits combined | Must not exceed 400,000 with all Group 2 and Subgroup 4.1-4.4 benefits combined |

| Subgroup 2.1 | Medical service fees for diagnosis | 25,000 | 30,000 | As charged | As charged |

| Subgroup 2.2 | Treatment medical services, blood services and nursing services | ||||

| Subgroup 2.3 | Medicine, intravenous nutrition and medical supplies | ||||

| Subgroup 2.4 | Expenses for Home medication and medical supplies (Medical Supply 1), per admission, net exceeding 7 days | 1,000 | |||

| Group 3 | Fees for medical professional services (physician), examination, physical services per confinement, not exceeding 125 days | 800 per day | 800 per day | 1,000 per day | 1,200 per day |

| Group 4 | Fees for surgery and procedures per confinement | Must not exceed 60,000 with all Subgroup 4.1-4.4 benefits combined | Must not exceed 100,000 with all Subgroup 4.1-4.4 benefits combined | Must not exceed 200,000 with all Subgroup 4.1-4.4 benefits combined | Must not exceed 400,000 with all Subgroup 4.1-4.4 benefits combined |

| Subgroup 4.1 | Operating or medical procedure room | 60,000 | 100,000 | As charged | As charged |

| Subgroup 4.2 | Medicine, intravenous nutrition and medical supplies and surgical devices | ||||

| Subgroup 4.3 | Medical professional services of surgery & procedure physician (and assistant) (Doctor fee), according to the doctor fee guideline | ||||

| Subgroup 4.4 | Physician fees-Anesthesiology Doctor fee, according to the doctor fee guideline | ||||

| Subgroup 4.5 | Medical expenses for organ transplantation are covered as charged (Limited 1 time per lifetime for this rider) | 120,000 | 200,000 | 200,000 | 400,000 |

| Group 5 | Day Surgery | As charged (considered as an in-patient benefit) | |||

| 2. Out-patient benefits | |||||

| Group 6 | Fees for diagnosis pre-and-post hospitalization or fees for OPD follow up treatment, which are directly related to hospitalization, per confinement | 3,000 | 3,500 | 5,000 | 5,000 |

| Group 6.1 | Fees for diagnosis directly related to in-patient treatment within 30 days pre-and-post hospitalization | ||||

| Group 6.2 | Fees for OPD follow up treatment (per admission) within 30 days after hospital discharge (excluding fees for diagnosis) | ||||

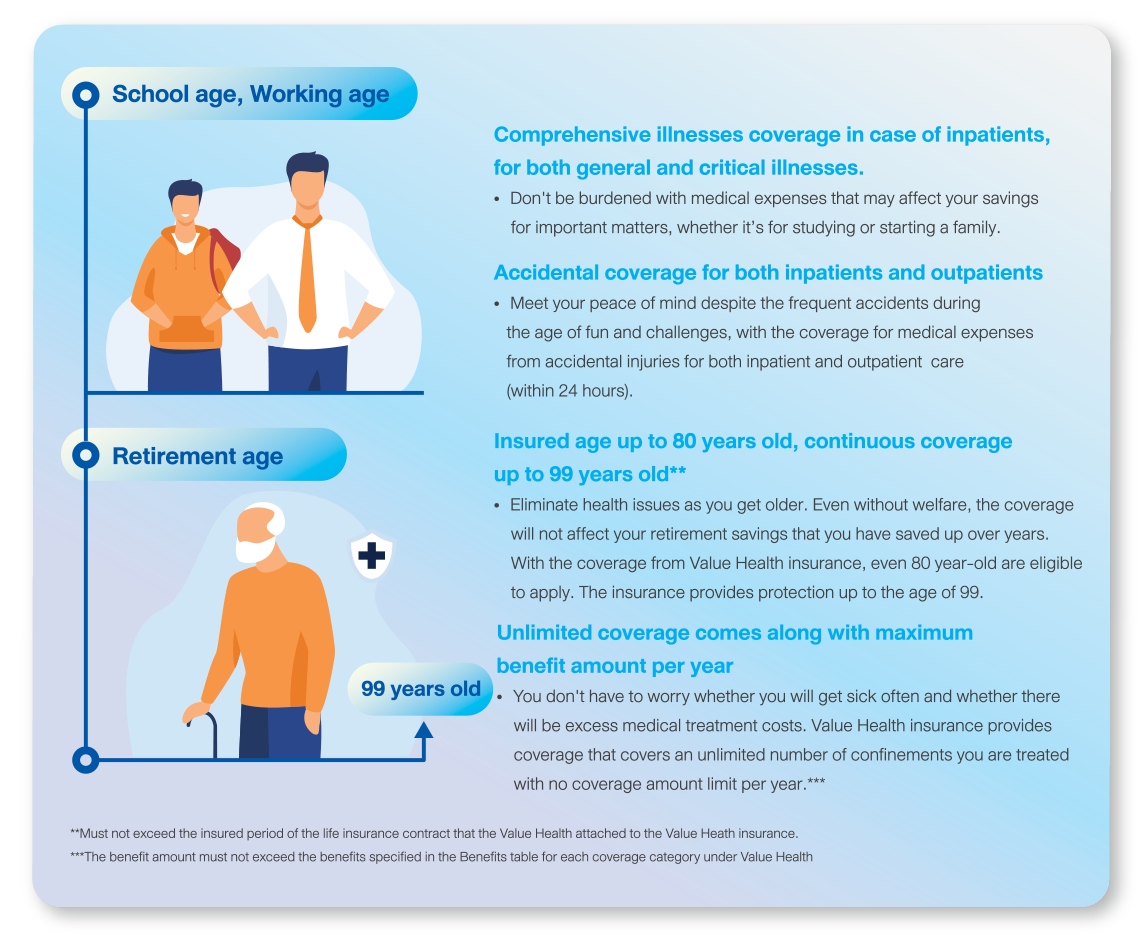

| Group 7 | Fees for OPD treatment of injury within 24 hours of each accident | 4,000 | 6,000 | 8,000 | 8,000 |

| Group 8 | Fee for each of the post-treatment rehabilitation per confinement | Not covered | |||

| Group 9 | Medical services fees for chronic kidney failure treatment by-hemodialysis per policy year | 20,000 | 35,000 | 50,000 | 50,000 |

| Group 10 | Medical services fees for tumour or cancer treatment by radiation therapy, interventional radiology, nuclear medicine, per policy year | ||||

| Group 11 | Medical services fees for cancer treatment by chemotherapy including targeted therapy per policy year | ||||

| Group 12 | Emergency ambulance fees per time | 2,000 | 3,000 | 4,000 | 5,000 |

| Group 13 | Medical expenses for minor surgery treatment per time | 6,000 | 9,000 | 10,000 | 10,000 |

| Deductible | None | ||||

| Additional benefits | |||||

| 3. Daily Hospitalization Compensation in case of in-patient but not exercising an in-patient benefit claim (not exceeding 10 days per policy year) | Not covered | 1,000 per day | |||

| Maximum benefits per policy year | None | ||||

| Example: Standard annual premium for male aged 30 year-old | 5,464 | 7,596 | 11,662 | 14,014 | |

| Example: Standard annual premium for female aged 30 year-old | 7,279 | 9,276 | 13,994 | 15,416 | |