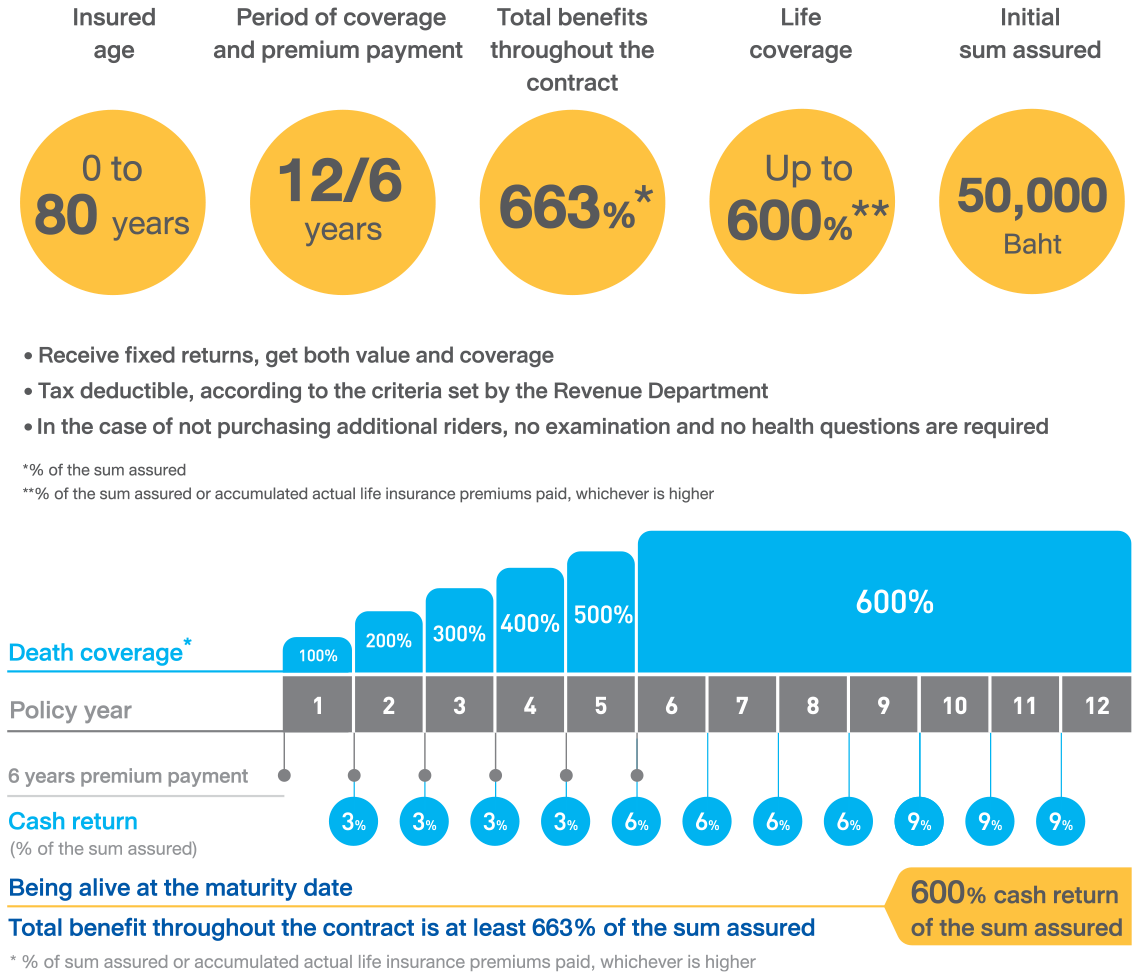

| Alive | Deceased |

|---|---|

| On the 1st - 4th policy anniversary, receive 3% annual cash return | The 1st policy year, receive 100% cash return |

| On the 5th - 8th policy anniversary, receive 6% annual cash return | The 2nd policy year, receive 200% cash return |

| On the 9th - 11th policy anniversary, receive 9% annual cash return | The 3rd policy year receive 300% cash return |

| On the maturity date, receive 600% cash return | The 4th policy year receive 400% cash return |

| (% of the sum assured) | The 5th policy year receive 500% cash return |

| The 6th - 12th policy year, receive 600% cash return | |

| (% of the sum assured or actual accumulated life insurance premiums paid, whichever is higher) |

Click to view Benefits and Coverage

Click to View Coverage Exclusions

BLA Happy Saving 126

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the coverage under the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part. Unless the insured does not have a stake in the insured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part, or if murdered by the beneficiary.

Note

- This advertising media is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Remittance of insurance premiums is the responsibility of the insured. The fact that life insurance agents and brokers offer to collect insurance premiums is a service only.

- A health declaration is one of the factors for underwriting and benefits payment consideration.

- Underwriting is in accordance with the underwriting conditions of the company.

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until maturity.

- BLA Happy Saving 126 insurance premiums and health insurance premium (if any) can be used for personal income tax deductions, according to the criteria set by the Revenue Department.

For more details, please contact our life insurance agents or financial advisors nationwide.