Unit : Baht

| Benefits | Plan 1,000,000 | Plan 5,000,000 | Plan 10,000,000 | ||||

|---|---|---|---|---|---|---|---|

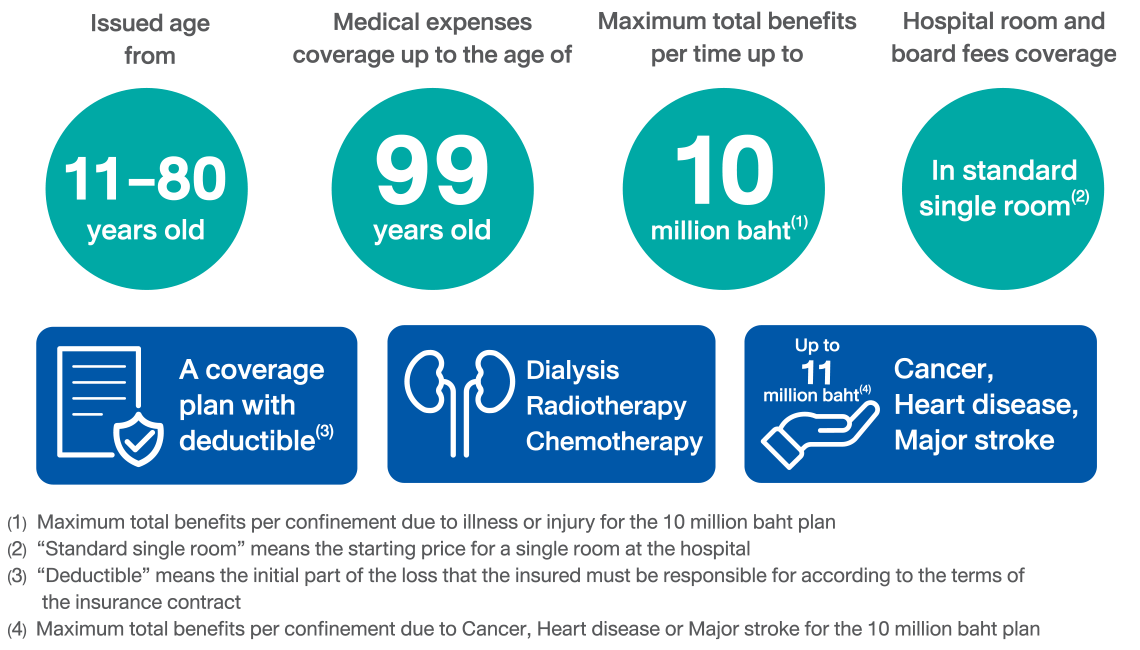

| Maximum total benefits per confinement due to illnesses or general injuries | 1,000,000 | 5,000,000 | 10,000,000 | ||||

| Maximum total benefits per confinement for Cancer, Heart disease, or Major stroke | 1,100,000 | 5,500,000 | 11,000,000 | ||||

| 1. In-patient benefits | |||||||

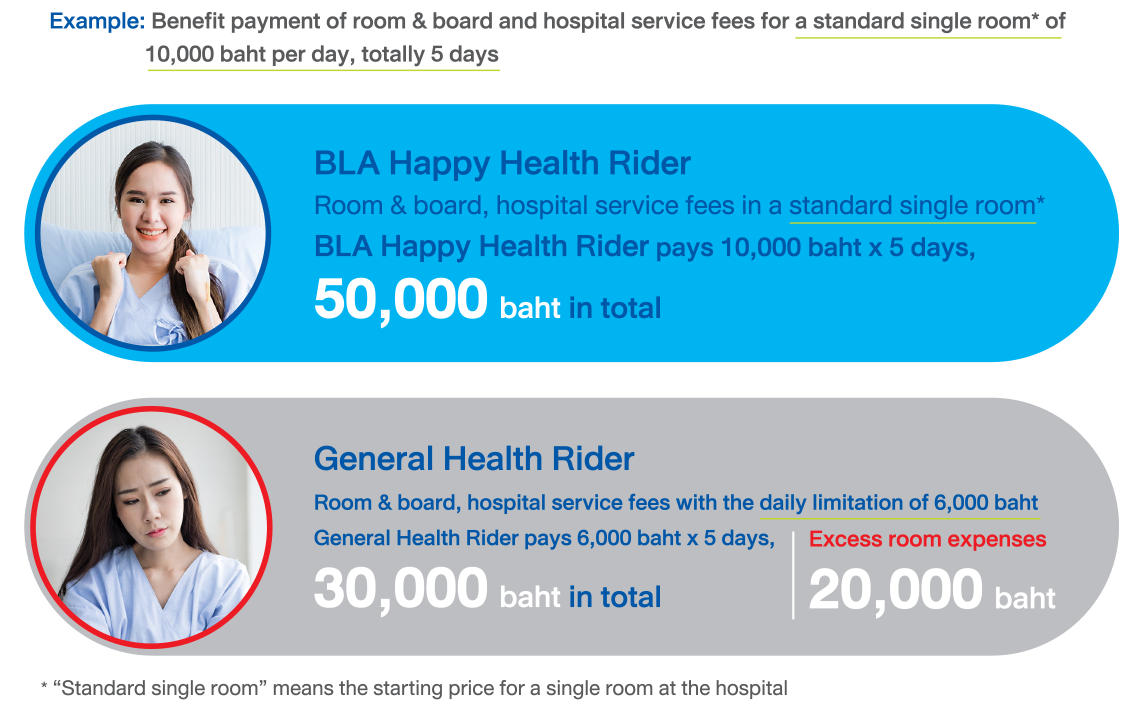

| Group 1 | Room & board, and hospital service fees (in-patient) per confinement as an in-patient (not exceeding 180 days) | As charged Total benefits must not exceed the starting single room fee | |||||

| In the event that the insured is in the Intensive Care Unit (ICU), room & board, and hospital service (in-patient) will be paid in full up to 60 days. With all the amount to days in Group 1 included, must not exceed 180 days. | As charged | ||||||

| Group 2 | Medical service fees for diagnosis or treatment, blood transfusion service and blood component fees, nursing service fees, medicine fees, parenteral nutrition fees, and medical supplies fees per confinement | As charged | |||||

| Subgroup 2.1 | Medical service fees for diagnosis | ||||||

| Subgroup 2.2 | Medical service fees for treatment, blood service and blood component, and nursing service | ||||||

| Subgroup 2.3 | Fees for medicine, parenteral nutrition, and medical supplies | ||||||

| Subgroup 2.4 | Take-home medicine and medical supplies (Medical Supply 1), not exceeding 7 days | 20,000 | 20,000 | 50,000 | |||

| Group 3 | Medical professional fees (Physician) for examination and treatment per confinement (not exceeding 180 days) | As charged | |||||

| Group 4 | Medical expenses for surgery and procedures per confinement | ||||||

| Subgroup 4.1 | Fees for operating or medical procedure room | ||||||

| Subgroup 4.2 | Fees for medicine, parenteral nutrition, medical supplies, and surgical devices | ||||||

| Subgroup 4.3 | Fees for medical professional services of surgery & procedure physician (and assistant) (Doctor fee), according to the doctor fee guideline | ||||||

| Subgroup 4.4 | Fees for medical professional services of anesthetist (Doctor fee), according to the doctor fee guideline | ||||||

| Subgroup 4.5 | Fees for organ transplantation are covered as charged (Limited 1 time per lifetime for this rider) | ||||||

| Group 5 | Major Surgery as an out-patient (Day Surgery) | ||||||

| 2. Out-patient benefits | |||||||

| Group 6 | Medical service fees for diagnostic examinations directly related to before and after in-patient treatments or medical fees for out-patient follow-up treatments after being discharged directly from in-patient treatments, per confinement | 2,000 | 2,000 | 10,000 | |||

| Subgroup 6.1 | Medical service fees for diagnostic examinations directly related to and occurred before and after being discharged directly from in-patient treatments, within 30 days | ||||||

| Subgroup 6.2 | Medical fees for out-patient follow-up treatments within 30 days after being discharged from in-patient treatments (excluding diagnostic examination fees), per admission | ||||||

| Group 7 | Out-patient medical service fees in case of injuries, within 24 hours of each accident | Not covered | 10,000 | ||||

| Group 8 | Fee for each of the post-treatment rehabilitation, per policy year | Not covered | |||||

| Group 9 | Medical service fees for chronic kidney failure treatment by-hemodialysis, per policy year | 100,000 | 100,000 | 200,000 | |||

| Group 10 | Medical service fees for the treatment of cancer and tumor by radiotherapy, interventional radiology, and nuclear medicine, per policy year | ||||||

| Group 11 | Medical service fees for cancer treatment by chemotherapy, including targeted therapy, per policy year | ||||||

| Group 12 | Emergency ambulance service fees | As charged | |||||

| Group 13 | Medical service fees for minor surgery | ||||||

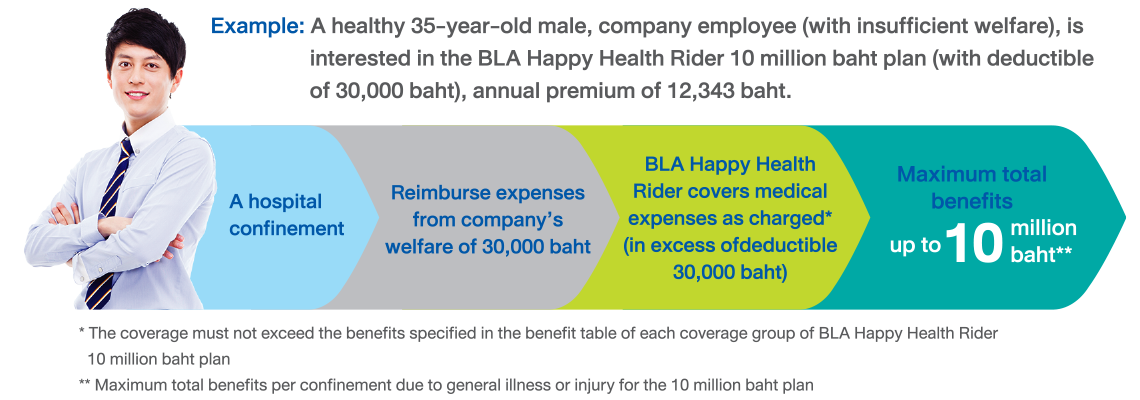

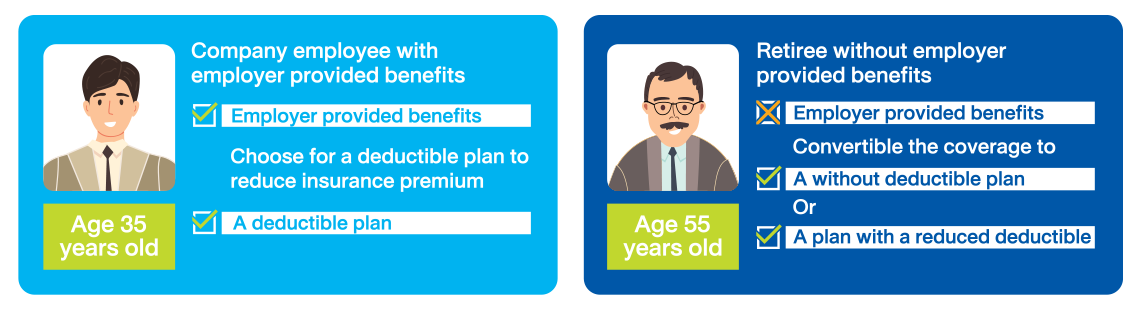

| Deductible per confinement (for benefits and coverage Group 1-5) | 30,000 | 100,000 | 30,000 | 100,000 | 30,000 | 100,000 | |

| Example Standard annual premium for male aged 35 years old | 9,225 | 3,148 | 10,333 | 3,747 | 12,343 | 5,291 | |

| Example Standard annual premium for female aged 35 years old | 10,308 | 3,244 | 11,339 | 3,880 | 13,157 | 5,135 | |

| The company will pay benefits for covered expenses incurred due to reasonably and medically necessary treatment. These benefits will not exceed the maximum amount specified in the Benefits Table. | |||||||