- Issued age : Newborn – 80 years

- Minimum sum assured : 1,000,000 baht

- Premium payment period : annually

- No medical examination and no health questions required

- Prestige Saving 10/4 consists of Prestige Saving 10/4 and BLA ADB rider*

- BLA ADB rider is a rider that the company provides coverage to the insured without paying premium

*The company reserves the right to consider accepting BLA ADB rider application according to the company's underwriting conditions.

Prestige Saving 10/4

| Coverages | Benefits |

|---|---|

| 1. Maturity benefit |

|

| 2. Non-accidental death in all cases |

|

BLA ADB Rider

| Coverages | Benefits |

|---|---|

| 1. Accidental death |

|

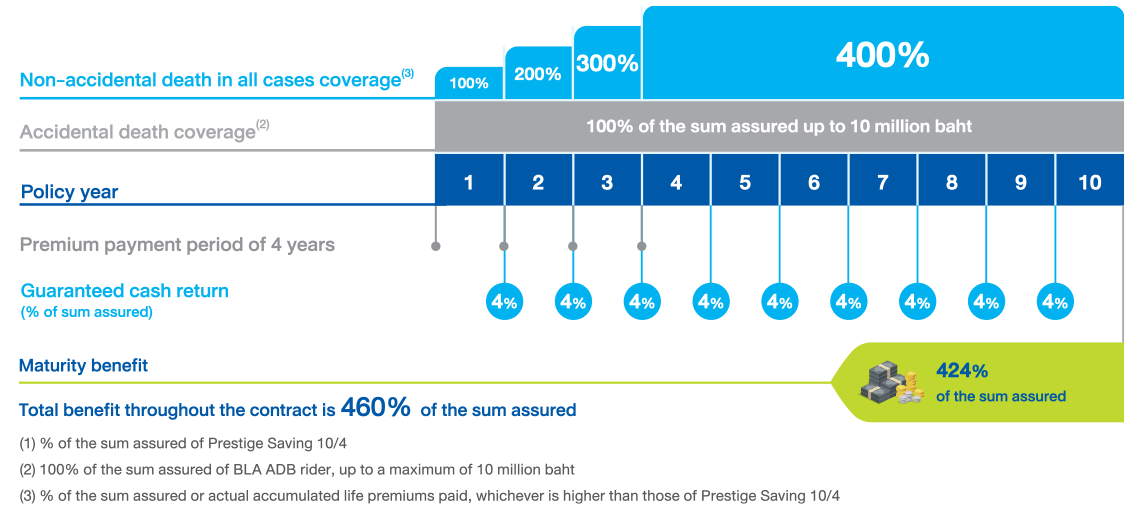

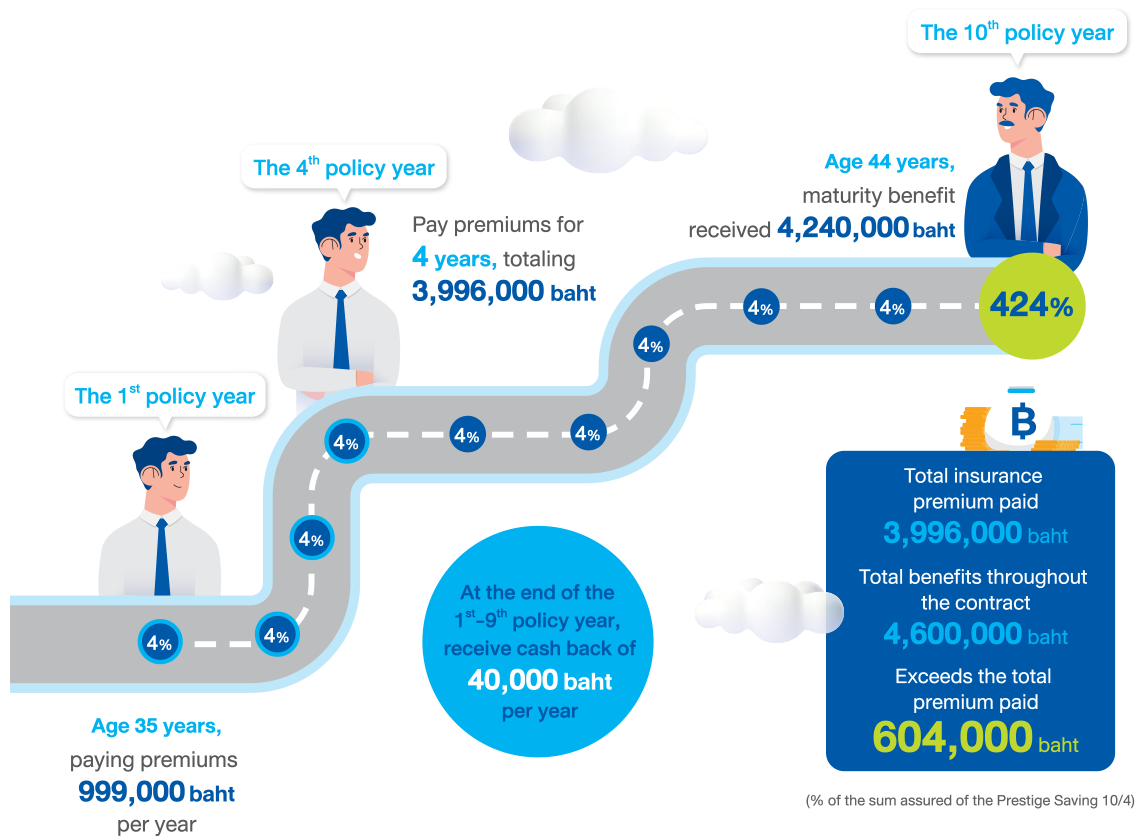

A 35-year-old man in good health. He applies for Prestige Saving 10/4 with a sum assured of 1,000,000 baht, an annual premium of 999,000 baht, and a personal income tax rate of 20% throughout the contract term.

Unit : Baht

| Policy year |

Premium (Beginning of policy year) | Cash return benefit (at policy anniversary)(1) |

Non-accidental death in all cases coverage(2) |

Accidental death coverage |

Policy surrender value | Total eligible cash back before maturity |

Tax benefits |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Prestige Saving 10/4 |

BLA ADB rider |

Annual total | Accumulated | % | Amount | % | Amount | 100% of the sum assured, up to a maximum of 10 million baht(3) |

Total benefits to receive(4) |

||||

| 1 | 999,000 | 0 | 999,000 | 999,000 | 4% | 40,000 | 100% | 1,000,000 | 1,000,000 | 2,000,000 | 403,000 | 443,000 | 20,000 |

| 2 | 999,000 | 0 | 999,000 | 1,998,000 | 4% | 40,000 | 200% | 2,000,000 | 1,000,000 | 3,000,000 | 1,123,000 | 1,203,000 | 20,000 |

| 3 | 999,000 | 0 | 999,000 | 2,997,000 | 4% | 40,000 | 300% | 3,000,000 | 1,000,000 | 4,000,000 | 1,929,000 | 2,049,000 | 20,000 |

| 4 | 999,000 | 0 | 999,000 | 3,996,000 | 4% | 40,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,889,000 | 3,049,000 | 20,000 |

| 5 | 3,996,000 | 4% | 40,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,875,000 | 3,075,000 | ||||

| 6 | 3,996,000 | 4% | 40,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,861,000 | 3,101,000 | ||||

| 7 | 3,996,000 | 4% | 40,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,846,000 | 3,126,000 | ||||

| 8 | 3,996,000 | 4% | 40,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,831,000 | 3,151,000 | ||||

| 9 | 3,996,000 | 4% | 40,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,816,000 | 3,176,000 | ||||

| 10 | 3,996,000 | 424% | 4,240,000 | 400% | 4,000,000 | 1,000,000 | 5,000,000 | 2,840,000 | 4,600,000 | ||||

| Total | 3,996,000 | 0 | 3,996,000 | 460% | 4,600,000 | 400% | - | - | - | - | - | 80,000 | |

(1) % of the sum assured of the Prestige Savings 10/4

(2) % of the sum assured, or actual accumulated life premium paid, whichever is higher under the Prestige Savings 10/4

(3) 100% of the sum assured of BLA ADB riders, up to a maximum of 10 million baht

(4) Total benefits in an event of accidental death is determined as a percentage of the % of the sum assured under the Prestige Saving 10/4(2) plus 100% of the BLA ADB rider, up to a maximum of 10 million baht(3)

- Cash return benefits, policy surrender value, and an eligible cash back before maturity are calculated at policy anniversary.

- An eligible cash back before maturity means the whole amount of cash back benefits already received, including the policy surrender value calculated at policy anniversary. Only the policy surrender value will be paid to the insured.

- BLA ADB rider is an additional rider that the company provides coverage to the insured without charging insurance premiums. The company reserves the right to consider insuring such additional contracts.

Unit : Baht

| Summary of tax deduction benefits throughout the contract | Before tax deduction | After tax deduction | |||||

|---|---|---|---|---|---|---|---|

|

3,996,000 | 3,916,000 | |||||

|

360,000 | 360,000 | |||||

|

4,240,000 | 4,240,000 | |||||

|

4,600,000 | 4,600,000 | |||||

| Benefits that exceed life insurance premiums (Item 4. - Item 1.) | 604,000 | 684,000 | |||||

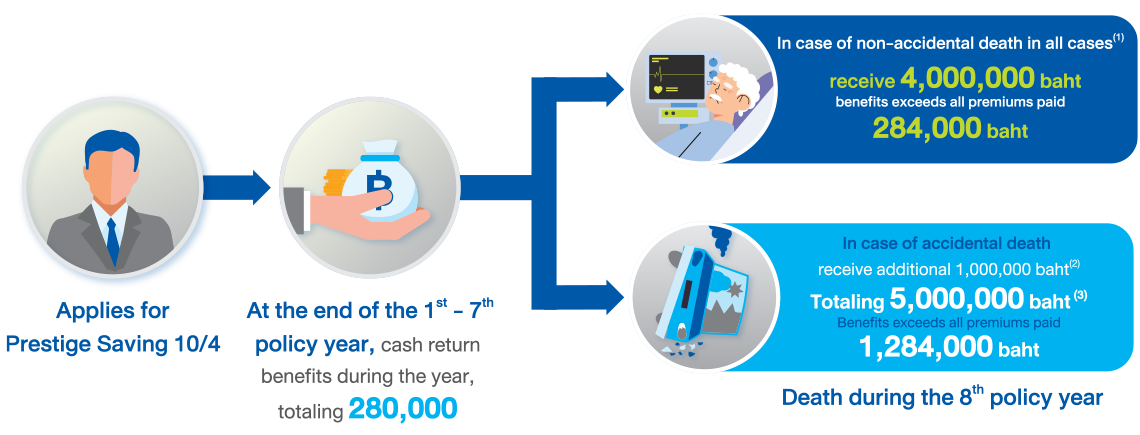

A life coverage with a large sum assured combined with higher accident coverage

Example A 35-year-old man in good health. He applies for Prestige Saving 10/4 with coverage period of 10 years, 4-year premium payment period, a sum assured of 1,000,000 baht, an annual premium of 999,000 baht.

1Maturity benefit

2Death while the policy is effective

(1) % of the sum assured, or actual accumulated life premiums paid, whichever is higher under Prestige Savings 10/4

(2) 100% of the sum assured of BLA ADB rider, up to a maximum of 10 million baht

(3) Total benefits in an event of accidental death is determined as a percentage of the % of the sum assured under the Prestige Saving 10/4(2) plus 100% of the BLA ADB rider, up to a maximum of 10 million baht(3)

Prestige Saving 10/4

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the coverage under the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part. Unless the insured does not have a stake in the insured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part, or if murdered by the beneficiary.

BLA ADB rider

Insurance under such rider does not cover loss or damage caused by the following events or circumstances:

- While the insured is driving or being a passenger on a motorcycle.

- Acts of the insured while under the influence of alcohol, addictive substances, or narcotics to the extent that the insured is unable to control consciousness. In the case of a blood test, being "under the influence of alcohol" means having a blood alcohol level of 150 milligrams percent or higher.

- Suicide, suicidal ideation, or self-harm.

- While the insured competes in a variety of races such as boat races, horse races, and ski races such as jet ski races, skate races, boxing, and parachute jumping (except survival parachute jumping). While taking off, landing, or traveling in a hot air balloon, or hang glider, bungee jumping, scuba diving, which involves tanks and underwater breathing apparatus.

- Back pain caused by Disc herniation, Spondylolisthesis, Degenerative Disc Disease, Spondylosis, Defect, or Pars Interarticularis Spondylosis. Unless there are fractures to dislocation of spinal caused by accident.

Note

- This advertising media is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Remittance of insurance premiums is the responsibility of the insured. The fact that life insurance agents and brokers offer to collect insurance premiums is a service only.

- A health declaration is one of the factors for underwriting and benefits payment consideration.

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until its maturity.

- Life insurance premiums of Prestige Saving 10/4 can be used for personal income tax deductions, according to the criteria set by the Revenue Department.

- Examples of coverage exemptions of the BLA ADB rider is a part of the coverage exclusions under the BLA ADB rider and is subject to the underwriting terms and conditions.