| Maximum total benefit per confinement from illness or general injuries |

500,000 |

1,000,000 |

5,000,000 |

10,000,000 |

| Maximum total benefit per confinement from cancer, cardiovascular disease, or stroke. |

550,000 |

1,100,000 |

5,500,000 |

11,000,000 |

| 1. In-patient benefits |

| Group 1 |

Room and board fees and hospital service fees (inpatient) per confinement as an inpatient, up to 180 days |

Standard Single Room |

| In the event that the insured is in the Intensive Care Unit (ICU), room and board fees and hospital services fees (inpatient) will be paid in full up to 60 days. With all the amount to days in Category 1 included, the benefits are up to 180 days. |

As charged |

| Group 2 |

Medical service fees for diagnosis or treatment, blood transfusion service and blood component fees, nursing service fees, medicine fees, parenteral nutrition fees, and medical supplies fees per confinement as an inpatient. |

|

| Subgroup 2.1 |

Medical service fees for diagnosis |

As charged |

| Subgroup 2.2 |

Medical service fees for treatment, blood services and blood component, and nursing service |

| Subgroup 2.3 |

Medicine, intravenous nutrition and medical supplies |

| Subgroup 2.4 |

Take-home medicine and medical supplies (Medical Supply 1), not exceeding 7 days |

5,000 |

20,000 |

20,000 |

50,000 |

| Group 3 |

Medical professional fees (Doctor) for examination and treatment per confinement as an inpatient (up to 180 days) |

As charged |

| Group 4 |

Medical service fees for surgery and surgical procedures per one confinement as an inpatient |

| Subgroup 4.1 |

Medical expense for operation (surgery) and procedures per policy year |

| Subgroup 4.2 |

Operating or medical procedure room |

| Subgroup 4.3 |

Medicine, intravenous nutrition, medical supplies and surgical devices |

| Subgroup 4.4 |

Fees for medical professional services of surgery & procedure physician (and assistant) (Doctor fee) |

| Subgroup 4.5 |

Fees for medical professional service of anesthetist (Doctor fee) |

| Group 5 |

Medical expenses for organ transplantation are covered as charged |

| 2. Out-patient benefits |

| Group 6 |

Medical service fees for diagnostic examinations before and after a directly related inpatient confinement or medical fees for outpatient follow-up treatments after being discharged from a directly related to a confinement as an inpatient |

1,000 |

2,000 |

2,000 |

10,000 |

| Subgroup 6.1 |

Medical service fees for diagnostic examinations before and after a directly related to a confinement as an inpatient, within 30 days |

| Subgroup 6.2 |

Medical fees for outpatient follow-up treatments after being discharged from a directly related confinement as an inpatient, within 30 days (excluding diagnostic examination fees). |

| Group 7 |

Outpatient medical service fees in case of injuries, within 24 hours from an accident per event |

Not covered |

10,000 |

| Group 8 |

Rehabilitation fees after a confinement as an inpatient, per one time per policy year |

Not covered |

| Group 9 |

Medical service fees for the treatment of chronic kidney disease by kidney dialysis through the blood vessels, per policy year |

50,000 |

100,000 |

100,000 |

200,000 |

| Group 10 |

Medical service fees for the treatment of cancer and tumor by radiotherapy, interventional radiology and nuclear medicine, per policy year |

| Group 11 |

Medical service fees for cancer treatment by chemotherapy and cancer cells targeted therapy, per policy year |

| Group 12 |

Emergency ambulance service fee |

As charged |

| Group 13 |

Medical service fees for minor surgery |

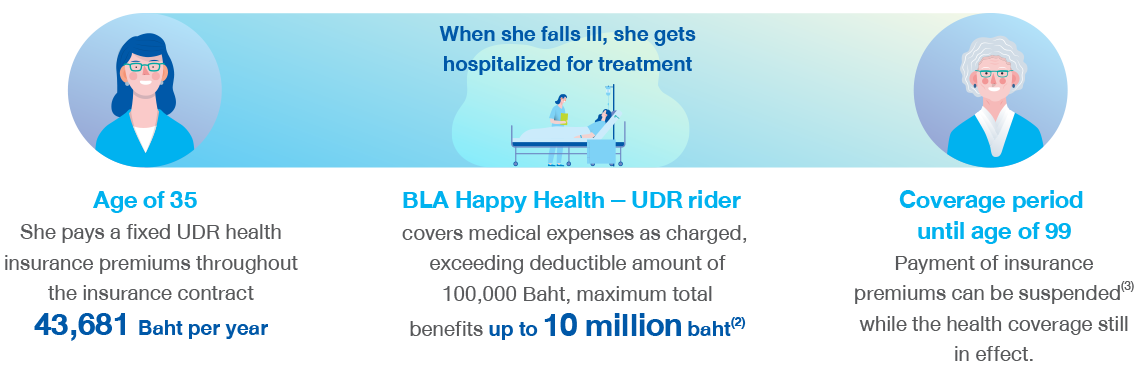

| Deductible per confinement |

- |

30,000 |

50,000 |

- |

30,000 |

50,000 |

100,000 |

- |

30,000 |

50,000 |

100,000 |

- |

30,000 |

50,000 |

100,000 |

| Extended clauses |

| Daily medical compensation for confinement without claiming inpatient benefits under BLA Happy Health - UDR with no deductible, up to 10 days per policy year |

1,000 |

- |

- |

2,000 |

- |

- |

- |

2,000 |

- |

- |

- |

2,000 |

- |

- |

- |